| LO2 - Describe horizontal and vertical trend analysis, and explain how they are used to analyze financial statements. |

Trend analysis is the evaluation of financial performance based on a restatement of financial statement dollar amounts to percentages. Horizontal analysis and vertical analysis are two types of trend analyses.

Horizontal analysis involves the calculation of percentage changes from one or more years over the base year dollar amount. The base year is typically the oldest year and is always stated as 100%.

Vertical analysis requires numbers in a financial statement to be restated as percentages of a base dollar amount. For income statement analysis, the base amount used is sales. For balance sheet analysis, total assets, or total liabilities and shareholders’ equity, are used as the base amounts. When financial statements are converted to percentages, they are called common-size financial statements.

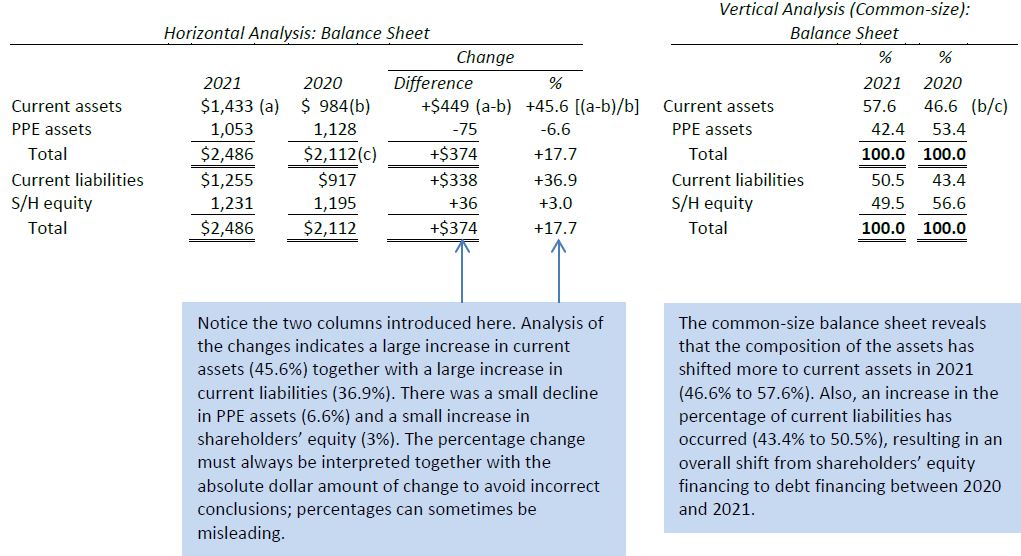

Horizontal and vertical analyses of the balance sheets of Big Dog Carworks Corp. are as follows:

The same analysis of BDCC’s income statement is as follows:

The percentages calculated become more informative when compared to earlier years. Further analysis is usually undertaken in order to establish answers to the following questions:

|

Horizontal Analysis: What caused this change? Is the change favourable or unfavourable? |

Vertical Analysis: How do the percentages of this company compare with other companies in the same industry? In other industries? |

These and similar questions call attention to areas that require further study. One item of note becomes more apparent as a result of the trend analysis above. Initially, it was stated that operating expenses were increasing between 2019 and 2021. Based on trend analysis, however, these expenses are actually declining as a percentage of sales. As a result, their fluctuations may not be as significant as first inferred. Conversely, the increases each year in cost of goods sold may be worrisome. Initial gross profit ratio calculations seemed to indicate little variation, and thus little effect on income from operations. However, given the increase in cost of goods sold (77% to 78%) may warrant further investigation.

- 21383 reads