| LO2 – Prepare a statement of cash flows. |

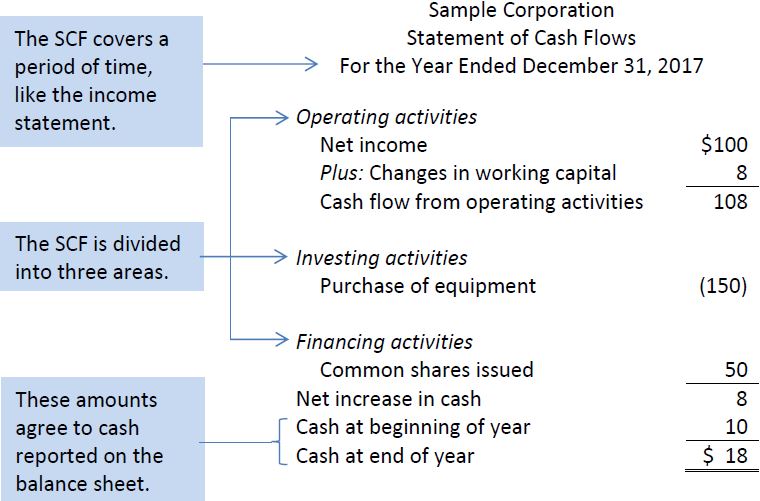

The statement of cash flows is classified into three sections: operating activities, financing activities, and investing activities. A simplified example is shown in Figure 14.1 below:

Cash flow from operations is generated from the principal activities that produce revenue for a corporation, such as selling products, and most of the expenses reported on the income statement, which are necessary to carry out these activities. Changes to non-cash working capital accounts like accounts receivable also affect cash generated by operating activities, as will be explained below.

Cash flows from investing activities involve increases and decreases in long–term asset accounts. These include outlays for the acquisition of property, plant, and equipment, as well as cash proceeds from their disposal.

Cash flows from financing activities occur when there are changes to debt or shareholders’ equity accounts, like when long-term debt is repaid or shares are issued. Dividend payments are also considered financing activities, since these represent a return on the original capital invested by shareholders.

The analysis of cash inflows and outflows focuses any transactions that involve a cash and cash equivalents account and any other balance sheet account. The following balance sheet format can be used to visualize this. The bold black line separates the cash and cash equivalent accounts from all other accounts.

Any transaction that affects one account above and one account below the black line results in either a cash inflow or a cash outflow. Such transactions cause changes to cash and cash equivalents.

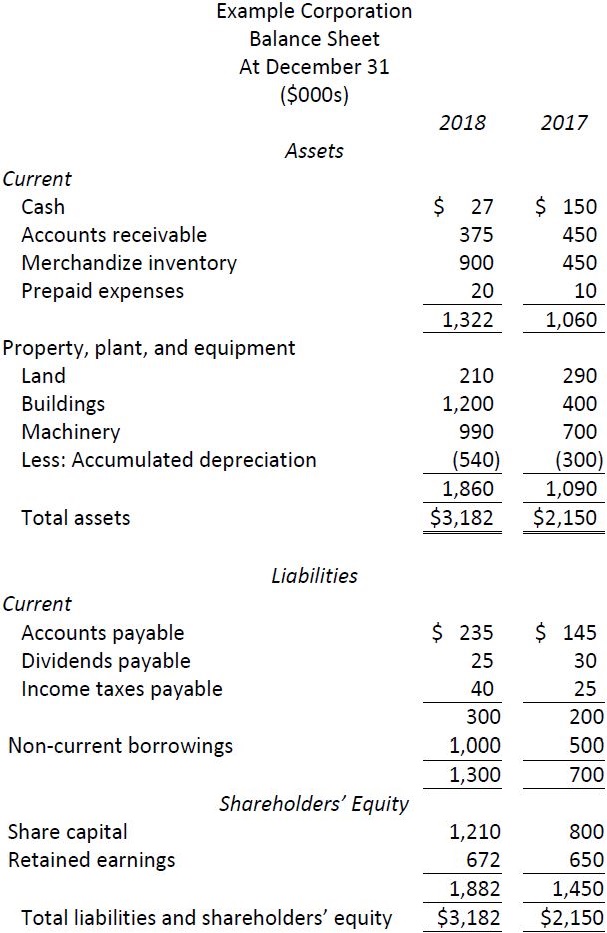

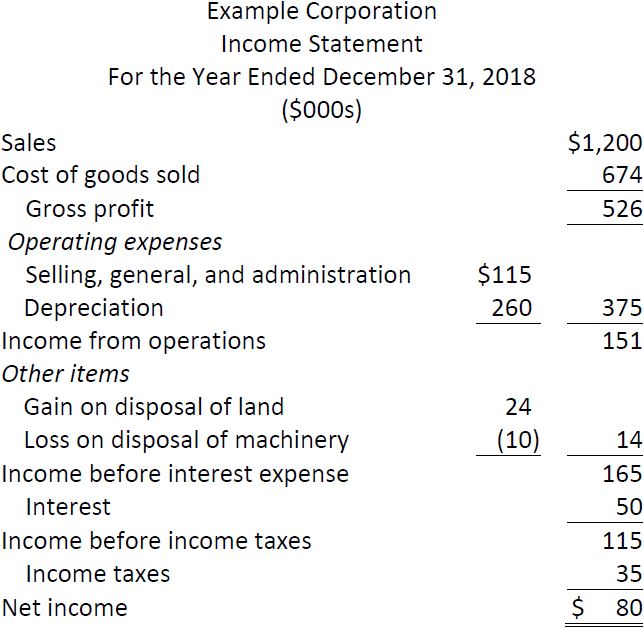

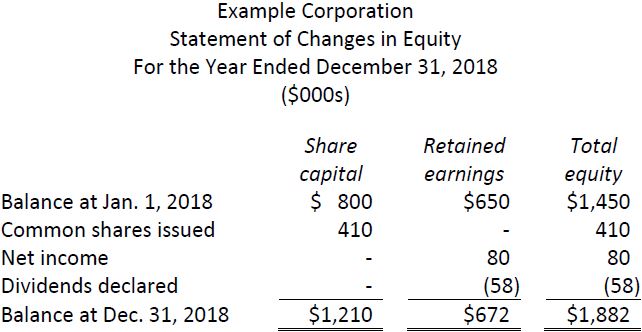

Consider the balance sheet, income statement and statement of changes in equity of Example Corporation:

The SCF can be prepared from an analysis of transactions recorded in the Cash account. Accountants summarize and classify these cash flows on the SCF for the three major activities noted above – operating, investing, and financing. To aid our analysis, the following summarized transactions from the records of Example Corporation will be used.

|

Transaction |

Description ($000s) |

|

1 |

Land costing $80 was sold for $104. |

|

2 |

A building was purchased for $800 cash. |

|

3 |

Machinery was purchased for $350 cash. |

|

4 |

Machinery costing $60 with accumulated depreciation of $20 was sold for $30 cash. |

|

5 |

Depreciation expense of $260 was recorded during the year. |

|

6 |

Example Company received $500 cash from a long-term bank loan. |

|

7 |

Shares were issued for $410 cash. |

|

8 |

$58 of dividends were declared and paid during the year. |

- 4791 reads