Available under Creative Commons-NonCommercial-ShareAlike 4.0 International License.

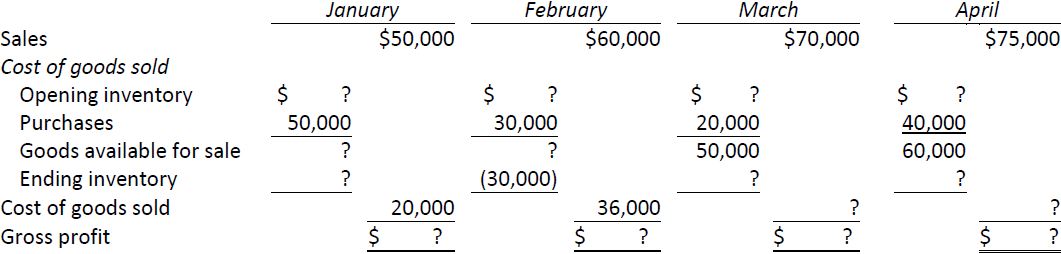

Donna Wood Corporation prepares monthly financial statements; it made a physical inventory count in January and February but intends to use the gross profit method to estimate inventory in March and April. Partial income statements appear below:

Required:

- Complete the partial income statements for January and February.

- Calculate the gross profit percentage to be used in estimating March and April ending inventories based on January and February percentages.

- Using the percentage calculated in question 2, complete the partial income statements for March and April.

- A physical count was made at April 30 and the inventory cost was accurately established at $10,000. Calculate the difference between the actual and estimated amounts.

- The president attributes the difference calculated in question 4 to the use of an incorrect gross profit percentage used to estimate ending inventory. Do you agree?

- 1614 reads