Liquidity is affected by management decisions related to trade accounts receivable. Slow collection of receivables can result in a shortage of cash to pay current obligations. The effectiveness of management decisions relating to receivables can be analyzed by calculating the accounts receivable collection period.

The calculation of the accounts receivable collection period establishes the average number of days needed to collect an amount due to the company. It indicates the efficiency of collection procedures when the collection period is compared with the firm’s sales terms (in BDCC’s case, the sales terms are net 30 meaning that amounts are due within 30 days of the invoice date).

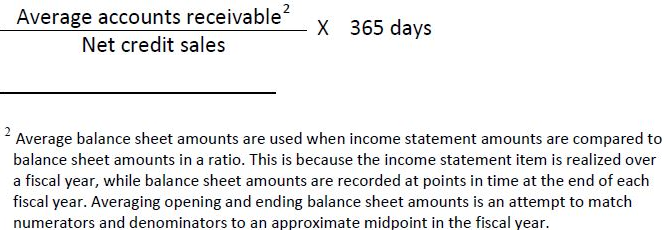

The accounts receivable collection period is calculated as:

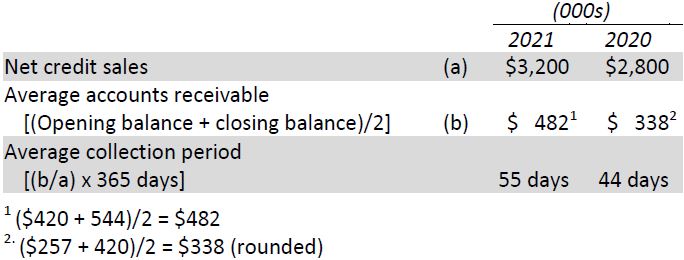

The BDCC financial information required to make the calculation is shown below (the 2019 calculation cannot be made because the 2018 Accounts Receivable amount is not available). Assume all of BDCC’s sales are on credit.

When Big Dog’s 30-day sales terms are compared to the 55-day collection period, it can be seen that an average 25 days of sales (55 days – 30 days) have gone uncollected beyond the regular credit period in 2021. The collection period in 2021 is increasing compared to 2020. Therefore, some over-extension of credit and possibly ineffective collection procedures are indicated by this ratio. Quicker collection would improve BDCC’s cash position. It may be that older or uncollectible amounts are buried in the total amount of receivables; this would have to be investigated.

Whether the increase in collection period is good or bad depends on several factors. For instance, more liberal credit terms may generate more sales (and therefore profits). The root causes of the change in the ratio need to be investigated. However, the calculation does provide an indication of the change in effectiveness of credit and collection procedures between 2020 and 2021.

- 8939 reads