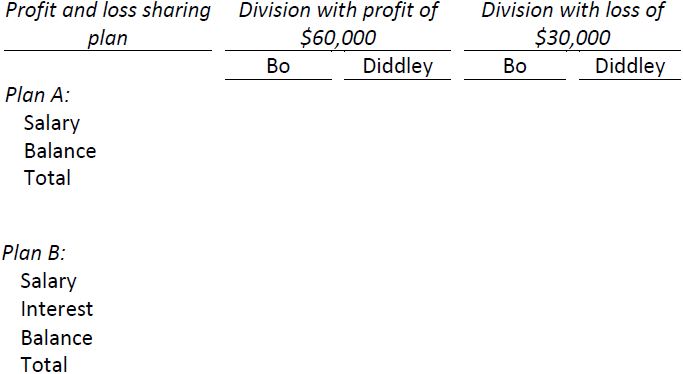

Bo and Diddley have decided to establish a partnership. Bo contributes $50,000 in cash; Diddley contributes $100,000 cash. They are evaluating two plans for a profit and loss sharing agreement:

|

Plan A |

Bo to receive a salary of $15,000 per year, the balance to be divided between Bo and Diddley according to their opening capital balance ratios. |

|

Plan B |

Bo to receive a salary of $12,000 per year; Bo and Diddley to receive 8 per cent interest per year each on their opening capital balances, and the balance of profit or loss to be split equally. |

|

Required: |

|

|

1. |

Calculate the division under each plan in the following schedule, assuming: (a) a profit of $60,000 per year, and (b) a loss of $30,000 per year. |

|

2. |

Comment on the advantages and disadvantages of each plan. |

- 2007 reads