The following information is taken from the records of East Oak Distributors Inc. The company uses the perpetual inventory system.

|

Date |

Units |

Unit Cost |

||

|

May |

1 |

Opening Inventory |

100 |

$1 |

|

5 |

Sale #1 |

80 |

||

|

6 |

Purchase #1 |

200 |

5 |

|

|

12 |

Purchase #2 |

125 |

3 |

|

|

13 |

Sale #2* |

300 |

||

|

19 |

Purchase #3 |

350 |

2 |

|

|

29 |

Purchase #4 |

150 |

1 |

|

|

30 |

Sale #3** |

400 |

||

*for specific identification, sold 175 units of purchase #1 and all units of purchase #2.

**for specific identification, sold 20 units of opening inventory, 300 units of purchase #3, and 80 units of purchase #4.

|

Required: |

||

|

1. |

Calculate cost of goods sold and the cost of ending inventory under each of the following inventory cost flow assumptions: |

|

|

a. |

FIFO |

|

|

b. |

Specific identification |

|

|

c. |

Weighted average. |

|

|

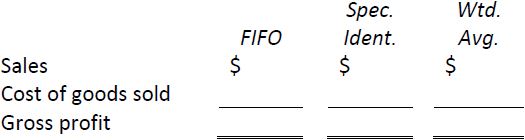

2. |

Assume each unit was sold for $5. Complete the following partial income statements : |

|

|

3. |

Which costing method would you choose if you wished to maximize net income? Maximize ending inventory value? |

|

- 1951 reads