| LO6 – Explain the purpose of closing entries and use closing entries to prepare a postclosing trial balance |

At the end of a fiscal year after steps 1-6 of the accounting cycle have been completed and financial statements have been prepared, the revenue, expense, and dividend account balances must be zeroed so that they can begin to accumulate amounts belonging to the new fiscal year. To accomplish this, closing entries are journalized and posted. Closing entries transfer each revenue and expense account balance, as well as any balance in the Dividend account, into retained earnings. Revenues, expenses, and dividends are therefore referred to as temporary accounts because their balances are zeroed at the end of each accounting period. Balance sheet accounts such as Cash and Retained Earnings, are permanent accounts because they have a continuing balance from one fiscal year to the next. The closing process transfers temporary account balances into the Retained Earnings account. An interim closing account called the Income Summary is used. In this text, its assigned general ledger account number is 360. The four entries in the closing process are detailed below.

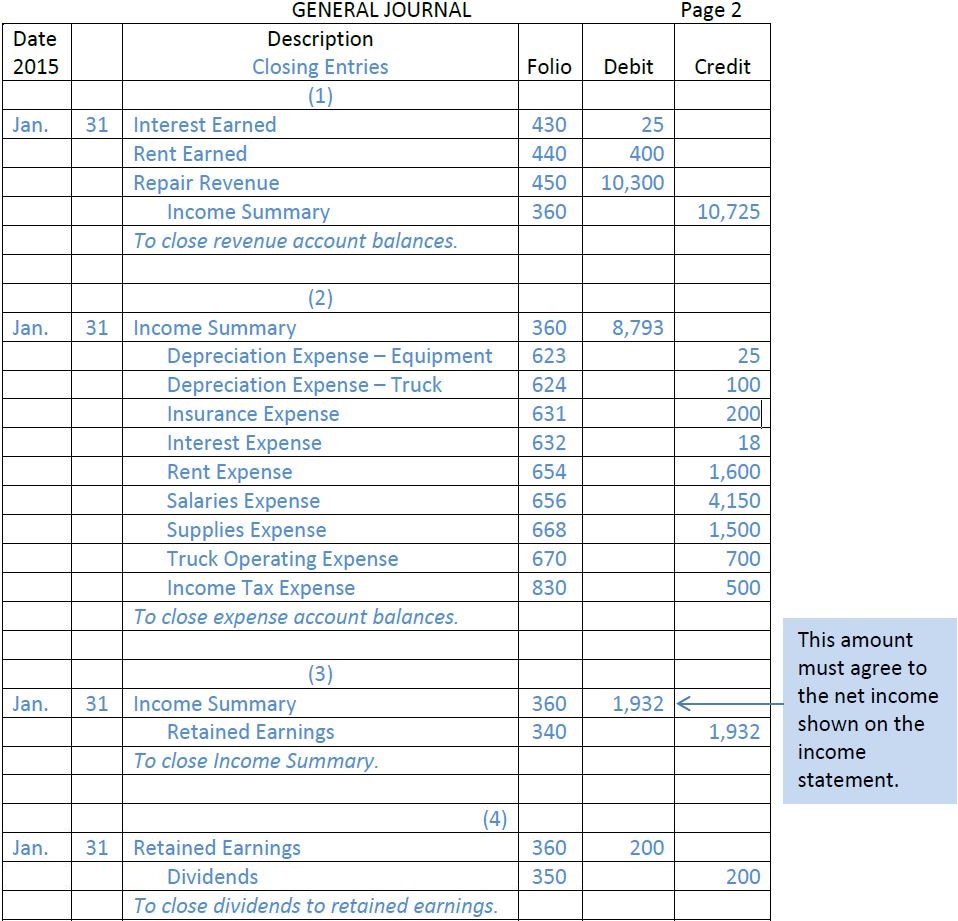

Entry 1: Close the revenue accounts to the Income Summary account

A single closing entry is used to transfer all revenue account (credit) balances to the Income Summary account. All revenue accounts with a credit balance are debited to bring them to zero. Their balances are transferred to the Income Summary account as an offsetting credit.

Entry 2: Close the expense accounts to the Income Summary account

A single closing entry is used to transfer all expense account (debit) balances to the Income Summary account. All expense accounts with a debit balance are credited to bring them to zero. Their balances are transferred to the Income Summary account as an offsetting debit.

The Dividend account is not closed to the Income Summary account because this is not an income statement account. The Dividend account is closed in Entry 4 directly to the Retained Earnings account.

After entries 1 and 2 above are posted to the Income Summary account, a new balance is calculated for the Income Summary account. If net income is reported on the income statement, the balance in the Income Summary should be a credit; if a net loss has been reported, the balance will be a debit. If the income summary balance does notmatch the net income or loss reported on the income statement, therevenues and expenses have not been closed correctly.

Entry 3: Close the Income Summary account to the Retained Earningsaccount

The balance in the Income Summary account is transferred to the Retained Earnings account because the net income belongs to the shareholders. An equal and offsetting entry (a debit in the case of net income) is made to the Income Summary account to bring its balance to zero. The same amount is credited to the Retained Earnings account. Again, the amount must always equal the net income reported on the income statement.

Entry 4: Close the Dividends account to Retained Earnings

The Dividend account is closed to the Retained Earnings account. This results in transferring the balance in dividends, a temporary account, to retained earnings, a permanent account.

The closing entries for Big Dog Carworks Corp. are shown in Figure 3.6.

These are for illustrative purposes only. Closing entries are only done atthe fiscal year-end.

- 3679 reads