| LO5 – Explain, calculate, and record the impairment of long-lived assets. |

Under generally accepted accounting principles, management must compare the recoverable amount of a depreciable asset with its carrying amount at the end of each reporting period. The recoverable amount is the estimated fair value of the asset at the time less any estimated costs to sell it. If the recoverable amount is lower than the carrying amount, an impairment loss must be recorded.

An impairment loss may occur for a variety of reasons: technological obsolescence, an economic downturn, or a physical disaster, for example. When an impairment is recorded, subsequent years’ depreciation expense must also be revised.

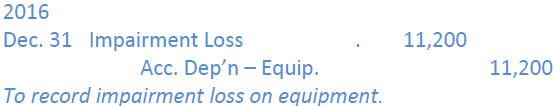

Recall again our $20,000 equipment purchased January 1, 2015 with an estimated useful life of five years and a residual value of $2,000. Assume straight-line depreciation has been recorded for 2015 amounting to $1,800. At December 31, 2016 and before 2016 depreciation is calculated, the carrying amount of the equipment is $18,200 ($20,000 – 1,800). At that point management determines that new equipment with equivalent capabilities can be purchased for much less than the old equipment due to technological changes. As a result, the recoverable value of the original equipment at December 31, 2016 is estimated to be $7,000, with no residual value. Because the recoverable amount is less than its carrying amount of $18,200, an impairment loss of $11,200 ($18,200 – 7,000) is recorded in the accounting records as follows:

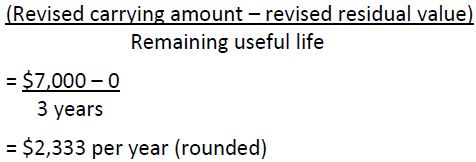

This reduces the carrying amount of the equipment to $7,000 ($20,000 – 1,800 – 11,200). Revised depreciation expense of $2,333 per year would be recorded at the end of 2017, 2018, and 2019, calculated as follows, assuming no change to original useful life and residual value:

- 2850 reads