First-in, first-out (FIFO) assumes that the first goods purchased are the first ones sold. A FIFO cost flow assumption makes sense when inventory consists of perishable items such as groceries and other time-sensitive goods.

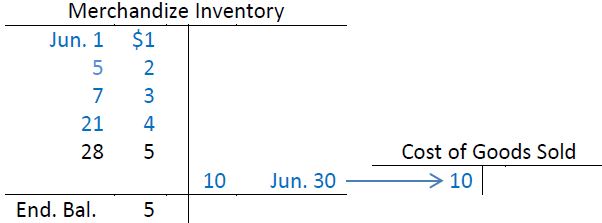

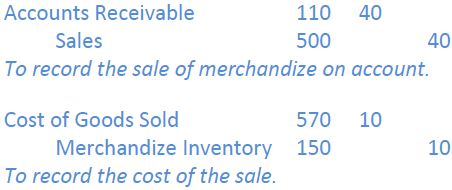

Using the information from the previous example, the first four units purchased are assumed to be the first four units sold under FIFO. The cost of the four units sold is $10 ($1 + $2 + $3 + $4). Sales still equal $40, so gross profit under FIFO is $30 ($40 – $10). The cost of the one remaining unit in ending inventory would be the cost of the fifth unit purchased ($5).

The general ledger T-accounts for Merchandize Inventory and Cost of Goods Sold as illustrated in Figure 6.3 would show:

The entry to record the sale would be:

- 3243 reads