The return on total assets ratio (ROA) is designed to measure the efficiency with which all of a company’s assets are used to produce income from operations. The ratio is calculated as:

Note that expenses need to finance the company operations are excluded from the calculation, specifically interest and income taxes. This is because all the assets of the company are considered in the ratio’s denominator, whether financed by investors or creditors. Average Total Assets are used in the calculation because the amount of assets used likely varies during the year. The use of averages tends to smooth out such fluctuations.

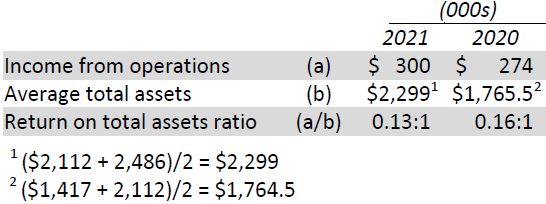

BDCC’s returns on total assets for 2020 and 2021 are calculated as follows:

The ratios indicate that Big Dog earned $0.13 of income from operations for every $1 of average total assets in 2021, a decrease from $0.16 per $1 in 2020. This downward trend indicates that assets are being used less efficiently. However, it may be that the increased investment in assets has not yet begun to pay off. On the other hand, although sales are increasing, it is possible that future sales volume will not be sufficient to justify the increase in assets. More information about the company’s plans and projections would be useful. Recall that ratio analysis promotes the asking of directed questions for the purpose of more informed decision making.

- 2854 reads