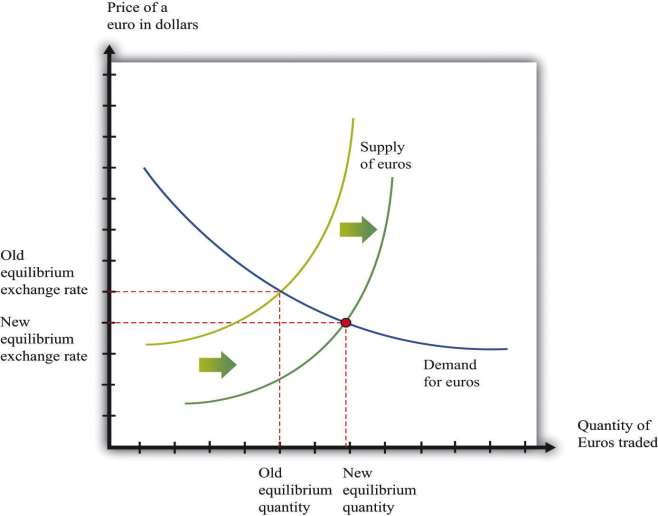

One of the articles we used to open this chapter dealt with changes in the value of the dollar in the fall of 2008. The article pointed out that the dollar was getting stronger relative to other currencies, such as the euro. This means that the price of a dollar in euros was increasing or, equivalently, the price of a euro in dollars was decreasing. In fact, the euro price of a dollar was about 0.67 in late September 2008; the price increased to nearly 0.81 by late October and then decreased again through December 2008. We can use the foreign exchange market to understand these events. *** Figure 4.14 "Comparative Statics in the Euro Market" shows the dollar market for euros once again. The increase in the value of the dollar discussed in the article is seen here as a rightward shift in the supply of euros, which decreases the value of the euro and—equivalently—increases the value of the dollar.

There are two consequences of this shift in the supply curve. First, the shift in supply decreases the dollar price of the euro. So people in the United States who are planning to visit, say, France will find that they can obtain more euros for a given amount of dollars. Second, the quantity of euros actually bought and sold is higher. This is not inconsistent with the lower dollar price of a euro since the supply curve shifts along the demand curve for euros.

- 1545 reads