The exchanges we have described so far have all been in terms of dollars. The interest rates paid on such exchanges are nominal interest rates. In a world where prices are increasing, however, the nominal interest rate does not represent the true cost of borrowing and lending.

To see why, begin by recalling that the inflation rate is defined as the percentage change in the price level. This means that the price level next year is equal to the price this year multiplied by (1 + inflation rate). [***If this is not clear to you, write out the inflation rate as follows: Then add one to both sides and multiply by the price level this year. ***] Now imagine that two individuals, Bert and Ernie, want to write a credit contract. Bert wants to borrow some money to buy a pizza. The price of a pizza this year is $10, so Ernie lends Bert $10, and they agree on a nominal interest rate for this credit arrangement. This means that next year he will repay $10 × (1 + nominal interest rate).

We could also imagine that Bert and Ernie decide to write a different kind of contract to guarantee a return in terms of pizzas. Because this rate of return is specified in terms of goods rather than money, it is a real interest rate. Ernie agrees to give Bert (enough dollars to buy) 1 pizza this year in return for being repaid (enough dollars to buy) (1 + real interest rate) pizzas next year. Ernie lends Bert $10 as before (the equivalent of 1 pizza). To repay this loan next year, Bert must give Ernie enough money to buy (1 + real interest rate) pizzas. The price of a pizza has increased to $10 × (1 + inflation rate), so Bert must give Ernie $10 × (1 + real interest rate) × (1 + inflation rate).

If you have worked through this chapter carefully, you probably know what is coming next. Because of arbitrage, we know that these two contracts must be equivalent:

1 + nominal interest rate = (1 + real interest rate) × (1 + inflation rate).

As an approximation, this equation implies that the [***To see this, multiply out the right-hand side and subtract $1 from each side to obtain nominal interest rate = real interest rate + inflation rate + real interest rate × inflation rate. Now, if the real interest rate and the inflation rate are small numbers, then when we multiply them together, we get a very small number that can be safely ignored. For example, if the real interest rate is 0.02 and the inflation rate is 0.03, then their product is 0.0006, and our approximation is about 99 percent accurate.***]

nominal interest rate ≈ real interest rate + inflation rate.

This relationship is called the Fisher equation.

Toolkit: Section 16.5 "Correcting for Inflation"

Nominal interest rates and real interest rates are related by the Fisher equation. To convert from nominal interest rates to real interest rates, we use the following formula:

real interest rate ≈ nominal interest rate − inflation rate.

If you want to know more about the Fisher equation, you can look in the toolkit.

For example, if a loan has a 12 percent interest rate and the inflation rate is 8 percent, then the real return on that loan is 4 percent. Since the nominal interest rate and the inflation rate are easily observed by most of us, we can use the Fisher equation to calculate the real rate of interest. We use the Fisher equation whenever we see a nominal interest rate and wish to convert it to a real interest rate. Just as it is the real exchange rate that matters for people trading goods and assets between countries, so it is the real interest rate that ultimately matters to borrowers and lenders in the economy.

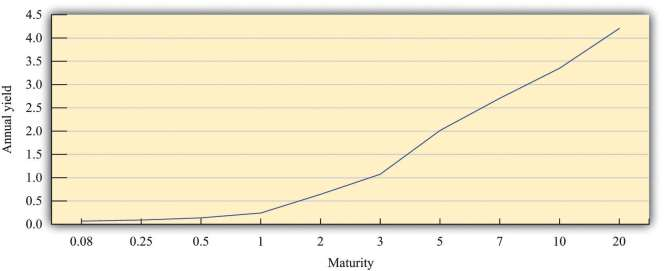

In macroeconomics, we often look at the credit market for the entire economy, where savings and investment are matched in the economy as a whole. The price in this market is the real interest rate. The response of savings and investment to the real interest rate is shown in **Figure 9.11 "The Credit Market". Once we know the equilibrium real interest rate, we calculate the implied nominal interest rate using the Fisher equation.

The (net) supply of loans in the domestic credit market comes from three different sources:

- The private savings of households and firms

- The savings or borrowing of governments

- The savings or borrowing of foreigners

Households will generally respond to an increase in the real interest rate by reducing current consumption relative to future consumption. Households that are saving will save more; households that are borrowing will borrow less. Higher interest rates also encourage foreigners to send funds to the domestic economy. Government saving or borrowing is little affected by interest rates.

National savings are defined as private savings plus government savings (or, equivalently, private saving minus the government deficit). The total supply of savings is therefore equal to national savings plus the savings of foreigners (that is, borrowing from other countries). The matching of savings and investment in the aggregate economy is described as follows:

investment = national savings + borrowing from other countries

or

investment = national savings − lending to other countries.

This is the same thing as saying that the flows in and out of the financial sector in the circular

flow must balance.

The demand for loans comes from firms who borrow to finance investment. As the real interest rate increases, investment spending decreases. For firms, a high interest rate represents a high cost of funding investment expenditures. This is evident if the firm borrows to purchase capital. It is also true if the firm uses internal funds (retained earnings) to finance investment since the firm could always put those funds in an interest-bearing asset instead.

Toolkit: Section 16.16 "The Circular Flow of Income"

The toolkit provides more detail on the flows in and out of the financial sector.

- 2220 reads