If you run a business, you often have to rely on credit (loans) to finance the purchase of your inputs into the production process. For example, suppose you run a boutique clothing store.

You have to buy the clothes to put on display first, and you get your revenues only when you sell the clothes. Weeks or even months may pass between the time you incur your costs and the time you get your revenues. Unless you have the funds available to buy all your stock up front, you will need to borrow. The same is true in many other businesses. Firms regularly take out short-term loans to pay for some of their costs of operation.

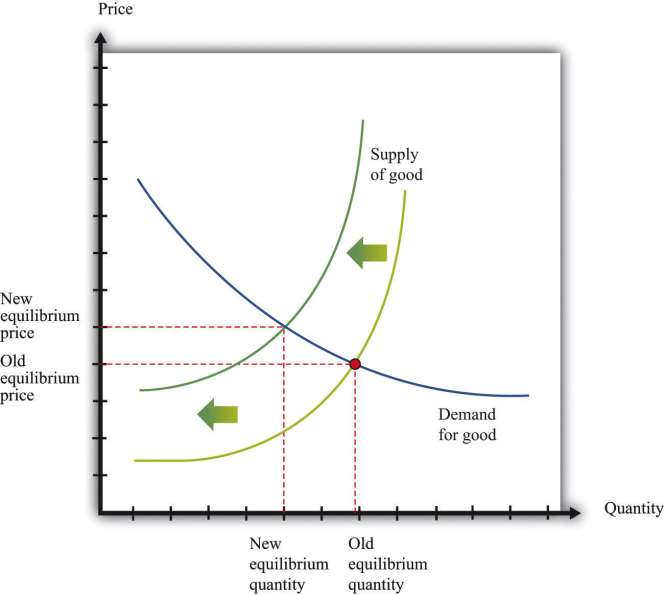

When interest rates increase, businesses see their costs increase. Higher costs make it less profitable to produce at any given price, so most businesses cut back on their production. Some may even leave the market altogether. As a consequence, the supply curve for most goods and services shifts leftward, as shown in Figure 4.18. We see that the equilibrium price increases, and the equilibrium quantity decreases. Going back to an individual producer, what does this mean? The producer sees costs increase. In the new equilibrium, the producer also obtains a higher price. However, the increase in price is not as big as the increase in cost.

- 1906 reads