The immediate question is, why do people work more in the United States? A natural place to look for explanations is the labor supply decisions of households. One possibility is simply that the tastes of US and European households are different. Perhaps Europeans prefer having fewer goods and more leisure. Although this is possible, economists prefer to start from the presumption that people have broadly similar tastes and look first to see if there are other plausible explanations.

The differences in hours worked are not explained by Europeans having poorer technology. Both the United States and European countries are highly developed, so technologies used in one country are used in the others as well. Supporting this is the fact that, as we already noted, productivity does not appear to be lower in Europe.

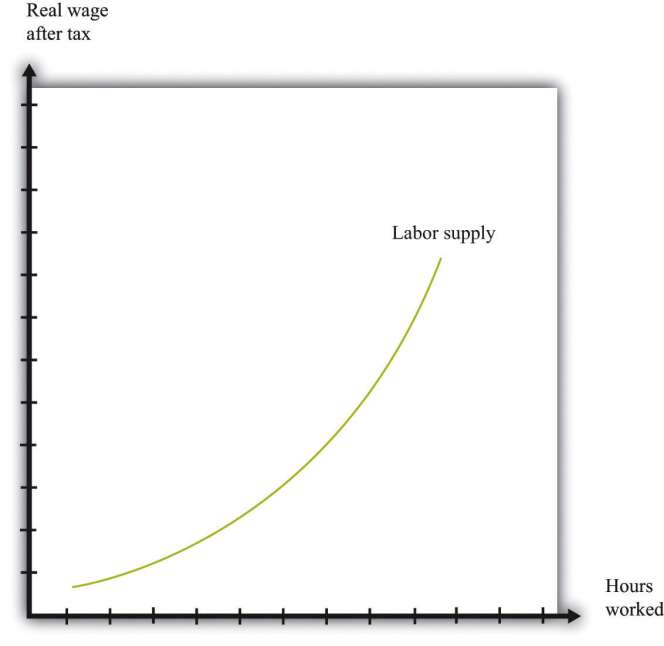

Another candidate explanation is that there are differences in the tax system. shows an individual labor supply curve—in either Europe or the United States. Notice in the wage on the vertical axis is the real wage after taxes. This is defined as follows:

real wage after taxes = real wage × (1 − tax rate).

In this equation, the tax rate is a marginal tax rate. This means that it is the tax paid on the extra amount you earnif you work a little bit more. Suppose the tax rate is 0.40 and your real wage per hour is $10. Then, if you work an extra hour, you pay $4 to the government, and you retain $6.

Toolkit: If you want to see the underpinnings of the labor supply curve, you can look in the toolkit. shows that an increase in the after-tax real wage will cause an individual to supply more time to the market and thus consume less time as leisure. The increase in the wage creates an incentive for the individual to substitute away from leisure because it has become more costly.

Suppose that we compare two identical individuals in Europe and the United States. If the marginal tax rate in Europe is higher than it is in the United States, then the after-tax wage in Europe will be smaller. Since labor supply is upward sloping, individuals in Europe will work less than individuals in the United States. For this to be a convincing explanation, two things must be true:

- Marginal tax rates must be higher in Europe.

- Labor supply must slope upward enough to match the differences in hours.

Marginal tax rates are indeed lower in the United States than in Europe. Recent research finds that the marginal tax rate on labor income is about 34.5 percent in the United States compared to 57.7 percent in Europe (Germany, France, Italy, and the United Kingdom).[*** Alberto F. Alesina, Edward L. Glaeser, and Bruce Sacerdote, “Work and Leisure in the U.S. and Europe: Why So Different?” (Harvard Institute for Economic Research, Working Paper #2068, April 2005), accessed June 30, 2011,http://www.colorado.edu/Economics/morey/4999Ethics/AlesinaGlaeserSacerdote2005 .pdf. ***] So, if you work an extra hour and earn a pretax wage of $10, then you would keep $6.55 in the United States and $4.23 in Europe.

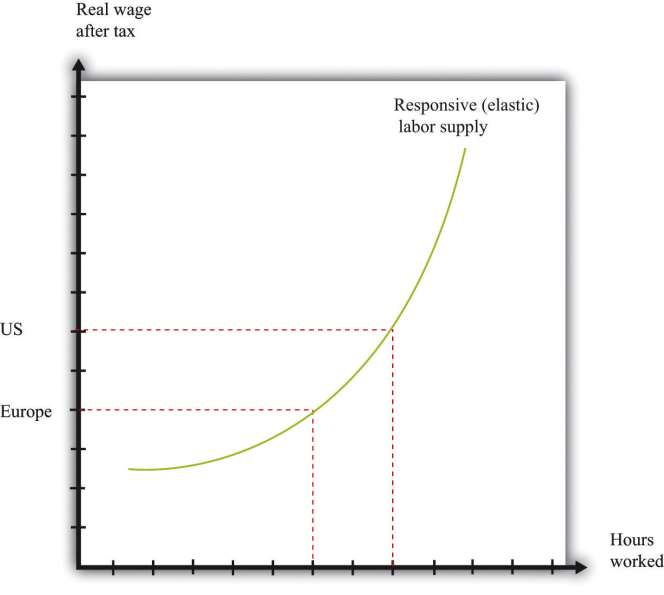

The evidence is also consistent with the view that labor supply increases as the after-tax real wage increases. shows the implication of this. On the vertical axis are two different levels of the after-tax real wage: a low one for Europe and a higher one for the United States. These differences in the after-tax real wage translate into differences in hours, using the labor supply curve of an individual. Thus, as in , individuals in the United States work more hours than in Europe. As this is true for everyone in the labor force, this argument immediately translates into a statement about hours worked for the aggregate economy.

There are two real wages after taxes shown: one for Europe and one for the United States. These differences in real wages translate into differences in hours worked.

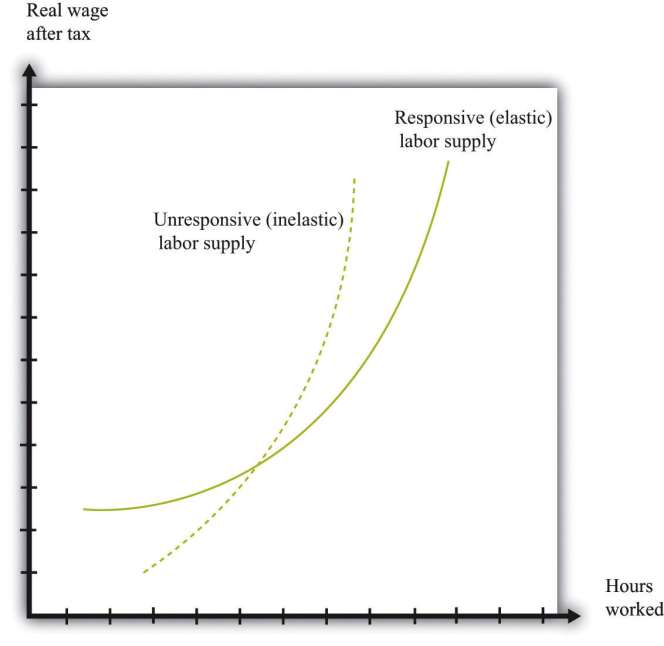

Can the difference in the after-tax real wage explain the observed difference in hours worked? This depends on how responsive labor supply is to changes in the real wage.shows two labor supply curves. In one case (the solid curve), labor supply is very responsive to changes in the wage. Relatively small differences in taxes then have substantial effects on hours worked. In the other case (the dashed curve), labor supply is not very responsive to the wage. Differences in tax rates are then unlikely to be able to explain the differences in hours worked.

Prescott argues that the difference in taxes between the United States and Europe is enough to account for the differences in hours worked. To make this argument, Prescott holds fixed the labor supply curve () across countries and asks how much of the observed difference in hours can be explained by tax policy. This is a movement along the labor supply curve because the vertical axis measures the after-tax real wage. To support this argument, however, Prescott assumes that labor supply is indeed quite responsive to changes in after-tax wages.

KEY TAKEAWAY

The average hours worked varies over countries. In the United States, the average hours worked are greater than in Europe.

One way to explain differences in hours worked is through the higher marginal labor income taxes paid in Europe.

***

Checking Your Understanding

Draw a diagram of the labor market to show how taste differences might explain differences in hours worked across countries.

In , why is a tax policy change a movement along the labor supply curve and not a shift in the labor supply curve?

- 2477 reads