The February 2005 announcement by the FOMC also included an increase in the discount rate. The discount rate is the interest rate from another market—in this case a market established by the Fed itself.

We have said that if a bank is short on reserves, it can borrow. One source of loans is the federal funds market. Another source of loans is the Fed itself. Member banks have the privilege of borrowing from the Fed, and the rate at which a bank can borrow is called the discount rate. The Fed directly controls this interest rate. The Federal Reserve’s policies on such loans are set out in “Regulation A” of the Fed’s Board of Governors: “A Federal Reserve

Bank [that is, a Regional Fed] may extend primary credit on a very short-term basis, usually overnight, as a backup source of funding to a depository institution that is in generally sound financial condition in the judgment of the Reserve Bank. Such primary credit ordinarily is extended with minimal administrative burden on the borrower.” [***“Regulation A (12 C.F.R. 201 as amended effective December 9, 2009),” Federal Reserve, accessed July 20, 2011, http://www.frbdiscountwindow.org/regulationa.cfm?hdrID=14&dtlID=77. ***] Once a bank has established the right to borrow at the Fed’s “discount window,” the execution of such a loan is straightforward. The bank simply makes a toll-free call and provides a few pieces of basic information.

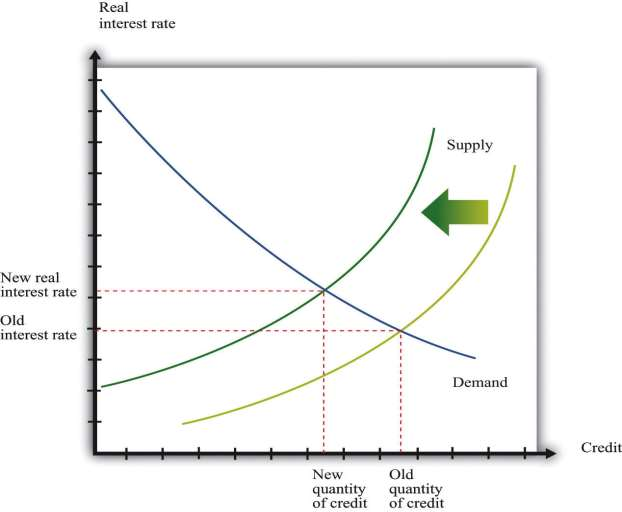

To see how this tool works, suppose the discount rate were very high, much higher than the interest the bank can earn by making a loan. Then the bank would find it prohibitively expensive to borrow from the Fed. If the bank were unsure that it could meet the needs of depositors, it would respond by holding reserves in excess of the reserve requirement. That is, with a very high discount rate, the bank would lend out a smaller fraction of its deposits. By contrast, if the Fed were to set the discount rate very low, the bank would make more loans and hold fewer reserves, safe in the knowledge that it could always borrow from the Fed if necessary. From this reasoning, we can see that as the discount rate is increased, banks hold more excess reserves and lend less. This shows up in ***Figure 10.21 "An Increase in the Discount Rate" as a shift inward in the supply of credit. Thus the Fed can increase interest rates by increasing the discount rate.

- 1497 reads