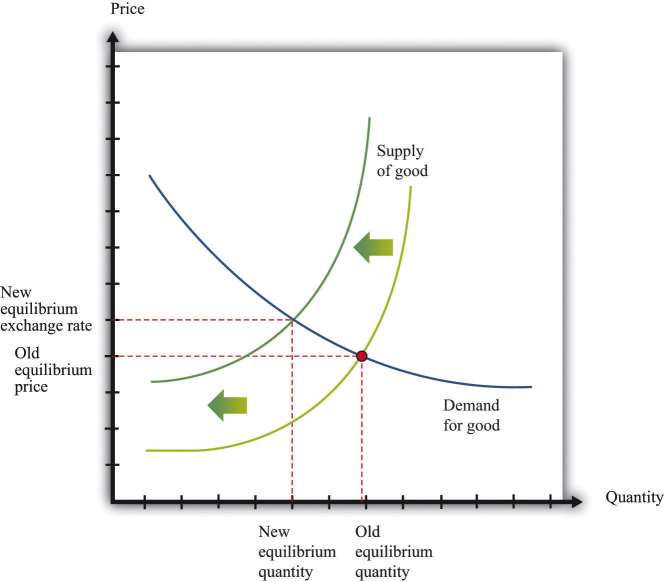

The story began with the first comparative static example that we looked at: a leftward shift in demand for housing. Potential buyers of houses started worrying that the futureprice of houses would decrease. This made people more reluctant to buy houses. Meanwhile, a tightening of lending standards made it harder for people to obtain loans. Both of these caused the demand for housing to shift leftward. Part (a) of ***Figure 4.17, which we already saw earlier in the chapter, shows us that this led to a decrease in both the price and the quantity of houses.

A decrease in demand for housing led to a decrease in supply of credit. (a) Worsening expectations about future house prices, together with tighter lending conditions, led to a decrease in demand for housing. (b) In the credit market, banks and other lending institutions found themselves with bad debt, so the supply of credit decreased.

Part (b) of ***Figure 4.17 also appeared earlier in the chapter. The decrease in housing prices, combined with the complicated way in which mortgages had been sold and resold by financial institutions, meant that many financial institutions found themselves in trouble. Some went bankrupt. This made financial institutions cautious about lending to each other, so the supply of credit shifted to the left. Interest rates rose. (Interest rates in the crisis were also affected by the actions of the US Federal Reserve and other monetary authorities around the world. [***We discuss such policies in detail when we return to the crisis in Chapter 15 "The Global Financial Crisis".***])

- 1651 reads