The inflation rate is defined as the growth rate of the overall price level. In turn, the price level in the economy is based on the prices of all the goods and services in an economy. From one month to the next, some prices increase, others decrease, and still others stay the same. The overall inflation rate depends on what is happening to prices on average. If most prices are increasing and few are decreasing, then we expect to see inflation.

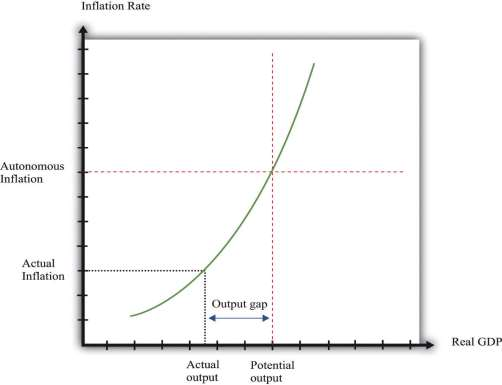

A complete explanation of inflation requires an understanding of all the decisions made by managers throughout the economy as they decide whether to change the prices of the goods and services that they sell. Some managers might find themselves facing increasing costs and strong demand for their product, so they would choose to increase prices. Others might have decreasing costs and weak demand, so they would choose to decrease prices. The overall inflation rate depends on the aggregation of these decisions throughout the economy and is summarized in a price adjustment equation. The price adjustment equation is shown in ***Figure 10.12 "Price Adjustment".

Toolkit: Section 16.20 "Price Adjustment"

The net effect of all the price-setting decisions of firms yields a price adjustment equation, which is as follows:

inflation rate = autonomous inflation − inflation sensitivity × output gap.

The price adjustment equation summarizes, at the level of the entire economy, all the decisions about prices that are made by managers throughout the economy. It tells us that there are two reasons for increasing prices. The first is that there may be underlying (autonomous) inflation in the economy, even when it is at potential output. This depends, among other things, on the inflation rate that firms anticipate. The second reason for increasing prices is if the output gap is negative. The output gap is the difference between potential output and actual output:

output gap = potential real GDP − actual real GDP.

A positive gap means that the economy is in recession—below potential output. If the economy is in a boom, then the output gap is negative.

The output gap matters for inflation because as GDP increases relative to potential output, labor and other inputs become scarcer. Firms see increasing costs and increase their prices as a consequence. The second term of the price adjustment equation shows that when real GDP is above potential output (the output gap is negative), there is upward pressure on prices in the economy. The inflation rate exceeds autonomous inflation. By contrast, when real GDP is below potential output (the output gap is negative), there is downward pressure on prices. The inflation rate is below the autonomous inflation rate. The “inflation sensitivity” tells us how responsive the inflation rate is to the output gap.

If the output gap were the only factor affecting prices in the economy, then we would often expect to see deflation—decreasing prices. In particular, we would see deflation whenever the economy was in a recession. Although the United States and some other economies have occasionally experienced deflation, it is relatively rare. We can conclude that there must be factors other than the output gap that cause inflation to be positive.

Autonomous inflation is the inflation rate that prevails in the economy when the economy is at potential output (the output gap is zero). In the United States in recent decades, the inflation rate has been positive but low, meaning that prices have been increasing on average but at a relatively slow rate. Autonomous inflation is typically positive because most economies have some growth of the overall money supply in the long run. A positive output gap then translates not into deflation but simply into an inflation rate below the level of autonomous inflation. Thus in the FOMC statement with which we opened this chapter, the discussion is not about how contractionary policy will cause deflation; it is about how this policy will moderate the inflation rate. Positive autonomous inflation means that firms will typically anticipate that their suppliers or their competitors are likely to increase prices in the future. A natural response is to increase prices, so actual inflation is positive.

- 1892 reads