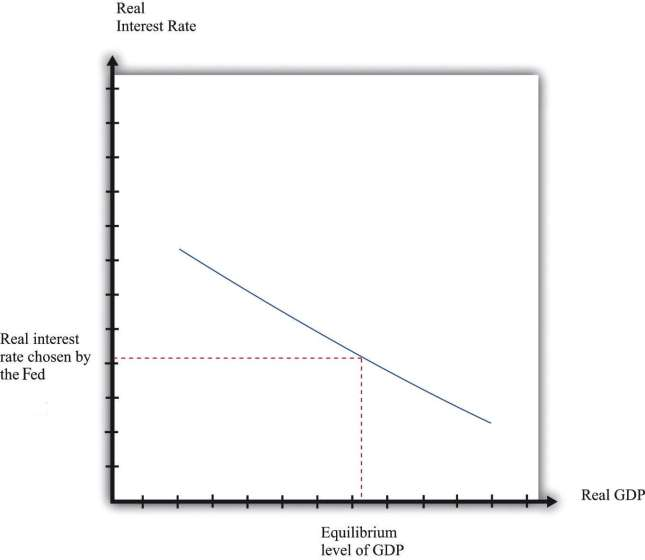

We can summarize much of the monetary transmission mechanism by means of a relationship between real interest rates and real GDP, as shown in ***Figure 10.10 "The Relationship between the Real Interest Rate and Real GDP". After we work through all the connections from real interest rates to the various components of spending and real GDP, we find that there is a level of real GDP associated with each real interest rate. The higher the interest rate, the lower is real GDP.

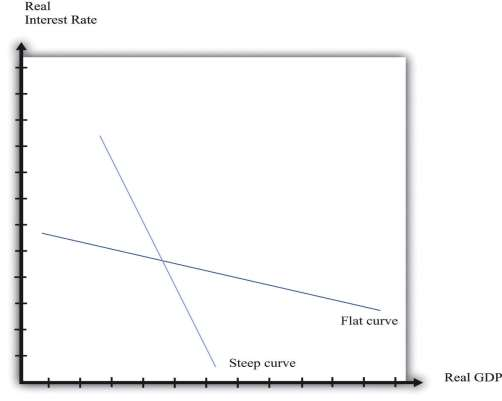

As the monetary authority changes the real interest rate, the economy moves along this curve. So, for example, a reduction in the real interest rate leads to increased spending on durables, which, through the multiplier process, increases aggregate output. The shape of the curve tells us something about the Fed’s ability to influence the economy. Suppose that (1) durable spending is very sensitive to the real interest rate and (2) the multiplier is large; then imagine that the Fed cuts interest rates. Firms and households both respond to this change. Firms decide to carry out more investment: they buy new machinery, open new plants, and so forth. Households, attracted by the low interest rates, borrow to buy new cars and new homes. As a result, durable spending increases substantially. Furthermore, this increase in spending leads to higher income and thus to further increases in spending by households. The end result is a large increase in real GDP. In this case, the curve is flat.

Figure 10.11 "The Fed’s Influence on the Economy Depends on the Real Interest Rate–Real GDP Relationship" shows both this case and the case where it is harder for the Fed to influence the economy. If spending on durable goods is not very responsive to changes in the real interest rate and the multiplier is small, then changes in interest rates end up having only a small effect on real GDP. In the diagram, this shows up as a steep curve. The Fed’s ability to use the monetary transmission mechanism to its advantage requires good knowledge of the shape of this relationship between interest rates and output.

KEY TAKEAWAY

The monetary transmission mechanism describes the links between the actions of the Fed and the state of the aggregate economy.

The Fed targets a short-term nominal interest rate called the federal funds rate. The Fed does not set this rate directly but rather uses its tools to influence this interest rate.

The main components of spending that depend on the real interest rate are spending by households on durable goods and investment. When these components of spending are sensitive to the interest rate, then the Fed can influence the economy through small variations in its target federal funds rate.

***

Checking Your Understanding

Which interest rate determines investment spending—the real interest rate or the nominal interest rate?

Some newspapers state that the Fed sets the interest rate. Is that right?

- 3772 reads