Even if there were no uncertainty about the current state of the economy—that is, the inflation rate and the output gap—monetary policy is still difficult for other reasons. First, as we emphasized earlier, the Fed does not have direct control over the long-term real interest rates that matter for durable goods spending. The Fed can influence a short-term nominal rate, which in turn influences the long-term real rates. But the exact link from one interest rate to the other is not known by the Fed and may change over time. The Fed may fail to achieve the long-term rate that it is aiming for.

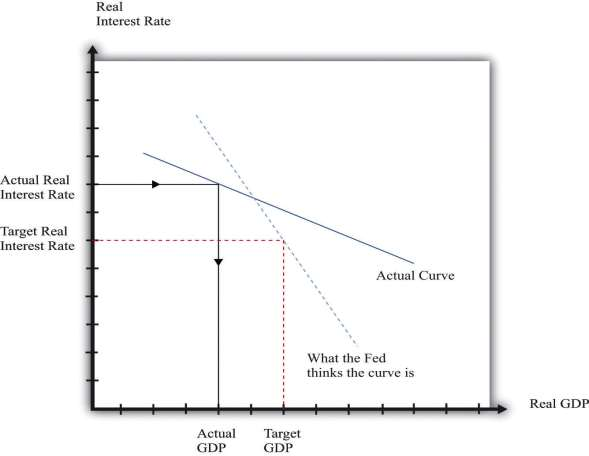

Second, the Fed does not have perfect knowledge of the monetary transmission mechanism. Consider again the links between real interest rates and output, as shown in***Figure 10.10 "The

Relationship between the Real Interest Rate and Real GDP". In reality, the Fed does not know exactly what the relationship between interest rates and output looks like. Reality looks more like*** Figure 10.23 "Controlling the Economy". In this picture the Fed is aiming for a high level of output. However, it misses its target real interest rate and actually ends up setting a higher real rate than it wanted. In addition, real GDP is more sensitive to interest rates than it thought, so the high rate leads to a big reduction in GDP. Thus because the Fed fails to achieve its target interest rate and also misjudges the monetary transmission mechanism, it ends up with much lower real GDP than it wanted.

Finally, the Fed has imperfect knowledge of the link between economy activity and price adjustment. Recall that the price setting equation stipulates that inflation depends on the output gap and something called autonomous inflation. As we have seen, this last term captures several factors, including the influence of expectations about the future on current price-setting behavior. This presents a double challenge to the Fed. First, to evaluate the effects of its policy on prices, the Fed needs to know the expectations that underlie autonomous inflation. Second, the Fed must recognize that its actions and statements influence these expectations. This is why the individuals involved in the making of monetary policy are so careful both about what they do and about what they say about what they do.

- 1452 reads