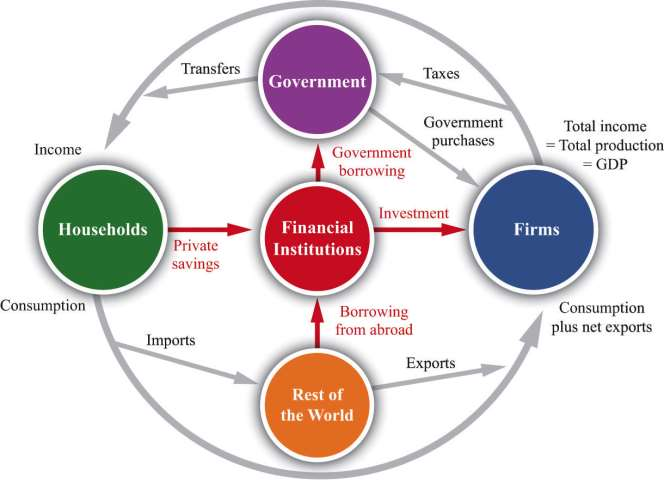

We can use the circular flow to help us understand how much investment there is in an economy. ***Figure 5.8 "The Flows In and Out of the Financial Sector" reviews the four flows of dollars in and out of the financial sector. [***The circular flow is introduced in Chapter 3 "The State of the Economy". We elaborate on it in Chapter 4 "The Interconnected Economy", Chapter 7 "The Great Depression", Chapter 12 "Income Taxes", and Chapter 14 "Balancing the Budget".***]

- Households put their savings into the financial sector. Any income that households receive today but wish to put aside for the future is sent to the financial markets. Although individual households both save and borrow, there is almost always more saving than borrowing, so, on net, there is a flow of dollars from the household sector into the financial markets (private savings).

- There is a flow of dollars between the financial sector and the government sector. This flow can go in either direction. Figure 5.8 "The Flows In and Out of the Financial Sector" is drawn for the case where the government is borrowing (there is a government deficit), so the financial markets send money to the government sector. In the case of a government surplus, the flow goes in the other direction. The national savings of an economy are the savings carried out by the private and government sectors taken together:

national savings = private savings + government surplus

or

national savings = private savings − government deficit.

- There is a flow of dollars between the financial sector and the foreign sector. This flow can also go in either direction. When our economy exports more than it imports, we are sending more goods and services to other countries than they are sending to us. This means that there is a flow of dollars from the economy as foreigners buy dollars so that they can make these purchases. It also means that we are lending to other countries: we are sending more goods and services to other countries now in the understanding that we will receive goods and services from them at some point in the future. By contrast, when our economy imports more than it exports, we are receiving more goods and services from other countries than we are sending to them. We are then borrowing from other countries, and there is a flow of dollars into the economy. ***Figure 5.8 "The Flows In and Out of the Financial Sector" illustrates the case of borrowing from other countries.

- There is a flow of dollars from the financial sector into the firm sector. These are the funds that are available to firms for investment purposes.

The total flows in and out of the financial sector must balance. Because of this, as we see from ***Figure 5.8 "The Flows In and Out of the Financial Sector", there are two sources of funding for new physical capital: savings generated in the domestic economy and borrowing from abroad.

investment = national savings + borrowing from other countries.

Or, in the case where we are lending to other countries,

investment = national savings − lending to other countries.

- 13750 reads