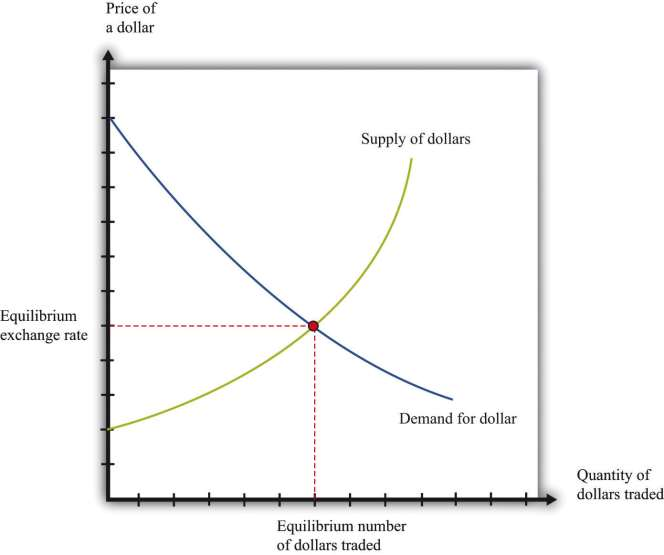

We sometimes look at an individual exchange rate (e.g., dollar-euro) by thinking of the market where dollars are exchanged for euros. However, there are many different currencies that are exchanged for the US dollar. There are markets where dollars are exchanged for British pounds, Japanese yen, and so on. We can combine these into an aggregate foreign exchange market. Think of this as being the market where US dollars are bought with and sold for all the other currencies in the world. In this market, there is an aggregate exchange rate, w hich you can think of as an average of the exchange rates in all the individual markets. [***More precisely, you should think of a weighted average. Because the United States trades much more with Canada than with, say, South Africa, movements in the US dollar–Canadian dollar exchange rate matter more than movements in the US dollar–South African rand exchange rate. Chapter 9 "Money: A User’s Guide" has more on exchange rates.***] We show this market in ***Figure 4.15 "Foreign Exchange Market Equilibrium".

KEY TAKEAWAY

The credit market brings together the suppliers of credit (households) with those who are demanding credit (other households, firms, and the government). The interest rate adjusts to attain a market equilibrium.

The labor market is where labor services are traded. Households supply labor, and firms demand labor. The real wage adjusts to attain a market equilibrium.

The foreign exchange market brings together demanders and suppliers of foreign currency. The exchange rate, which is the price of one currency in terms of another, adjusts to attain a market equilibrium.

***

Checking Your Understanding

***Figure 4.13 "Equilibrium in the Foreign Exchange Market Where Dollars and Euros Are Exchanged" shows the market where euros are bought and sold using dollars. We could equivalently think about this as the market where dollars are bought and sold using euros. Draw the graph for this market. How are the supply and demand curves in the two markets related to each other?

- 2734 reads