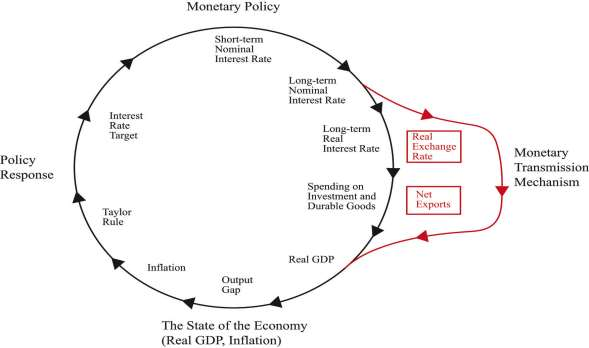

The key element in the monetary transmission mechanism is the ability of the central bank to influence the real interest rate. Changes in real interest rates lead to changes in spending on durable goods, which are a component of aggregate expenditures. But there is also another channel of influence. If the Fed cuts interest rates, for example, then the demand for dollars to invest in US asset markets will be reduced. This will reduce the foreign currency price of dollars. The weaker dollar means that goods produced in the United States are cheaper, so US exports will increase, and US imports will decrease. Thus changes in interest rates lead to changes in exchange rates, which in turn lead to changes in net exports. Net exports are also a component of aggregate expenditures. This is illustrated in ***Figure 10.17.

Even when we include this channel, it is just as easy to understand the monetary transmission mechanism as it was before. When interest rates are cut, there is an increase both in spending on durables and net exports. Both channels lead to higher aggregate spending and thus higher output.

Toolkit: Section 16.10 "Foreign Exchange Market"

You can review the workings of the foreign exchange market and the definition of the exchange rate in the toolkit.

- 2750 reads