LEARNING OBJECTIVES

After you have read this section, you should be able to answer the following questions:

What is potential output?

How could a decrease in potential output create the Great Depression?

How does the theory that the Great Depression was caused by a decrease in potential output match the facts?

Our first approach to interpreting the Great Depression focuses on potential output, which is the amount of real gross domestic product (real GDP) an economy produces when the labor market is in equilibrium and capital goods are not lying idle. We start here because this approach corresponds reasonably closely to the economic wisdom of the time.

A Decrease in Technology: The Multiple-Markets Perspective

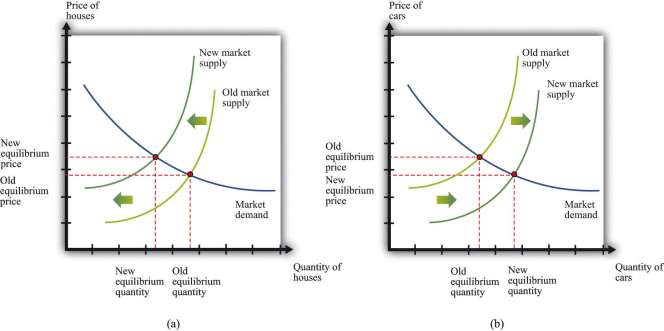

Comparative statics is a technique that allows us to understand the effects of a decrease in technology in a particular market, such as the market for new homes. In a comparative statics exercise, we look at what happens to endogenous variables (in this case, production and prices of new homes) when we change an exogenous variable (in this case, technology). A decline in technology shifts the market supply curve leftward: at any given price, the decrease in technology means that the firm can produce less output with its available inputs. The result is shown in part (a) of ***Figure 7.4 "An Inward Shift in the Market Supply of Houses" for the housing market: output of new homes decreases and the price of new homes increases.

Toolkit: Section 16.8 "Comparative Statics"

You can review the technique of comparative statics and the definition of endogenous and exogenous variables in the toolkit.

If this decline in technology in the housing market were the only change in the economy, what would happen? Construction firms would fire workers because these firms were building fewer new homes. Over time, however, the fired construction workers would find new jobs in other sectors of the economy. The same logic applies to other inputs: capital and other inputs that were being used in the construction industry would be redeployed to other markets. For example, there would be additional labor and other inputs available for automobile production. Part (b) of ***Figure 7.4 "An Inward Shift in the Market Supply of Houses" shows the resulting outward shift in the supply curve for cars. It is difficult to explain the big decrease in output and the high rate of unemployment in the Great Depression through a change in technology in a single market.

Suppose, however, that this change in technology does not happen in just one market but occurs across the entire economy. Then a version of part (a) in ***Figure 7.4 "An Inward Shift in the Market Supply of Houses" would hold for each market in the economy. We would see declines in economic activity across a wide range of markets. Moreover, with declines in so many industries, we would expect to see lower real wages and less employment. The idea that workers could easily move from one industry to another is not as persuasive if the entire economy is hit by an adverse technology shock.

- 2611 reads