LEARNING OBJECTIVES

After you have read this section, you should be able to answer the following questions:

What are the main components of aggregate spending?

What is the national income identity?

What happened to consumption and investment spending during the Great Depression?

What is consumption smoothing?

In his analysis of the Great Depression, John Maynard Keynes contrasted his new approach with the prevailing “classical” theory: [***John Maynard Keynes, The General Theory of Employment, Interest and Money (Orlando: First Harvest/Harcourt, 1964[1936]), 3.***] “I shall argue that the postulates of the classical theory are applicable to a special case only and not to the general case.…Moreover, the characteristics of the special case assumed by the classical theory happen not to be those of the economic society in which we actually live, with the result that its teaching is misleading and disastrous if we attempt to apply it to the facts of experience.” Keynes claimed that there was a fundamental failure in the economic system that prevented markets from fully coordinating activities in the economy. He argued that, as a consequence, the actual output of the economy was not determined by the productive capacity of the economy, and that it was “misleading and disastrous” to think otherwise. In more modern terms, he said that actual output need not always equal potential output but was instead determined by the overall level of spending or demand in the economy.

Keynes provided a competing story of the Great Depression that did not rely on technological regress and in which unemployment truly reflected an inability of households to find work. Keynes gave life to aggregate spending—the total spending by households, firms, and governments—as a determinant of aggregate gross domestic product (GDP). With this new perspective, Keynes also uncovered a way in which government intervention might help the functioning of the economy.

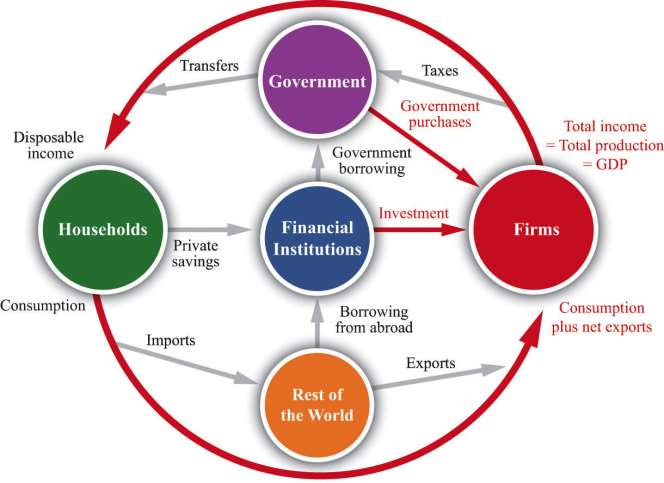

To understand how Keynes approached the puzzle of the Great Depression, we must first look more closely at the components of GDP. ***Figure 7.5 "The Firm Sector in the Circular Flow" shows the circular flow, emphasizing the flows in and out of the firm sector of the economy. Accounting rules tell us that in every sector of the circular flow, the flow of dollars in must equal the flow of dollars out. We know that the total flow of dollars from the firm sector measures the total value of production in the economy. The total flow of dollars into the firm sector equals total expenditures on GDP. The figure therefore illustrates a fundamental relationship in the national accounts.

- 2263 reads