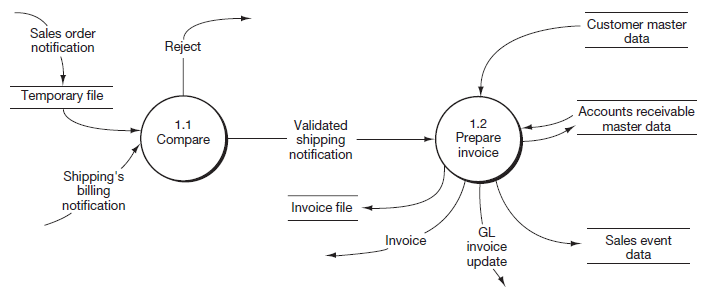

Figure 12.12 decomposes bubble 1.0 of Figure 12.4. Most of Figure 12.12 should be self-explanatory. As you saw in THE “ORDER-TO-CASH” PROCESS: PART I, MARKETING AND SALES (M/S), when the M/S process produces a sales order, it notifies the RC process to that effect. These notifications are filed temporarily,1 until such time that M/S informs RC that the goods have been shipped. When triggered by the data flow “Shipping’s billing notification,” process 1.1 validates the sale by removing the sales order notification from the temporary file and comparing its details to those shown on shipping’s billing notification. If discrepancies appear, the request is rejected, as shown by the reject stub coming from bubble 1.1. Rejected requests later would be processed through a separate exception routine.

If the data flows match, process 1.1 sends a validated shipping notification to process 1.2. Process 1.2 then performs the following actions simultaneously:

- Obtains from the customer master certain standing data needed to produce the invoice.

- Creates the invoice and sends it to the customer.

- Updates the accounts receivable master data.

- Adds an invoice to the sales event data.

- Files a copy of the invoice in the invoice file.

- Notifies the general ledger that a sale has occurred (GL invoice update).

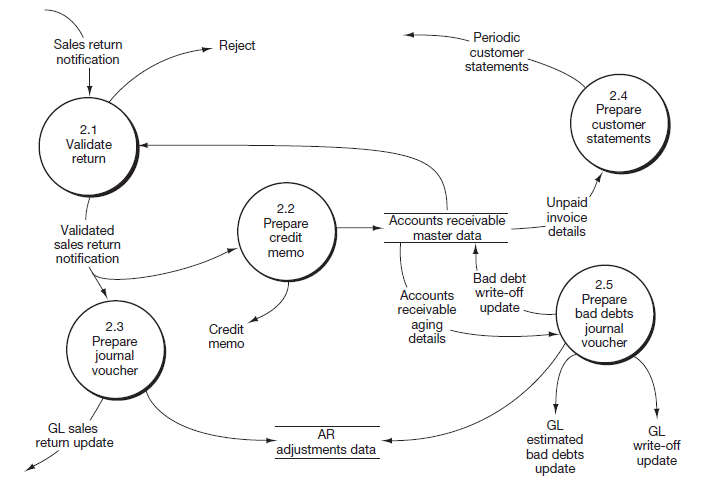

Now let’s take a closer look at process 2.0 in Figure 12.4. Figure 12.13 is the lower-level diagram of that process.

As mentioned earlier, managing customer accounts involves an array of activities that typically occur between customer billing and later cash collection. Three of those activities are reflected in Figure 12.13: (1) sending periodic statements of account to customers, (2) accounting for sales returns and allowances or other accounts receivable adjustments, and (3) accounting for bad debts. The tasks required to maintain customer accounts can be resource intensive for an organization.

Now let’s examine briefly the processes that are diagrammed in Figure 12.13. In general, adjustments will always be necessary to account for sales returns, allowances for defective products or partial shipments, reversals of mispostings and other errors, estimates of uncollectible accounts, and bad debt write-offs. In Figure 12.13, processes 2.1 through 2.3 relate to sales returns adjustments. Process 2.5, “Prepare bad debts journal entry,” is triggered by a temporal event; namely, the periodic review of aging details obtained from the accounts receivable master data. One of two types of adjustments might result from this review:

- The recurring adjusting entry for estimated bad debts

- The periodic write-off of “definitely worthless” customer accounts

Note that, regardless of type, adjustments are recorded in the event data, updated to customer balances in the accounts receivable master data, and summarized and posted to the general ledger master data by the general ledger system.

Like process 2.5, bubble 2.4, “Prepare customer statements,” is also triggered by a temporal event. In other words, it recurs at specified intervals, quite often on a monthly basis in practice. Details of unpaid invoices are extracted from the accounts receivable master data and are summarized in a statement of account that is mailed to customers. The statement both confirms with the customer the balance still owing and reminds the customer that payment is due. Therefore, it serves both operating and control purposes.

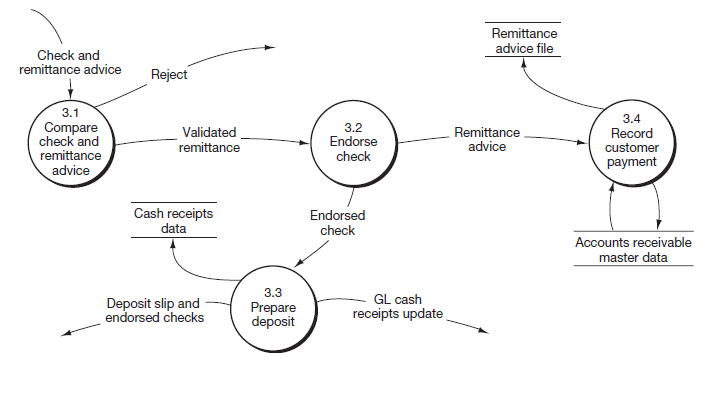

Figure 12.14, a lower-level diagram of process 3.0 “Receive payment” in Figure 12.4, completes our analysis of the events comprising the RC process. In this diagram, we see our earlier activities culminate in the collection of cash from customers. The check and remittance advice trigger the Receive payment process.

On receipt of the check and remittance advice from a customer, process 3.1 first validates the remittance by comparing the check to the RA. Mismatches are rejected for later processing. If the check and RA agree, the validated remittance is sent to process 3.2, which endorses the check and separates the check from the RA. Process 3.3 accumulates a number of endorsed checks, prepares and sends a bank deposit to the bank, records the collection with the cash receipts data, and notifies the general ledger system of the amount of the cash deposited.

While process 3.3 is preparing the deposit, process 3.4 uses the RA to update the accounts receivable master data to reflect the customer’s payment and then files the RA in the remittance advice file.

- 4108 reads