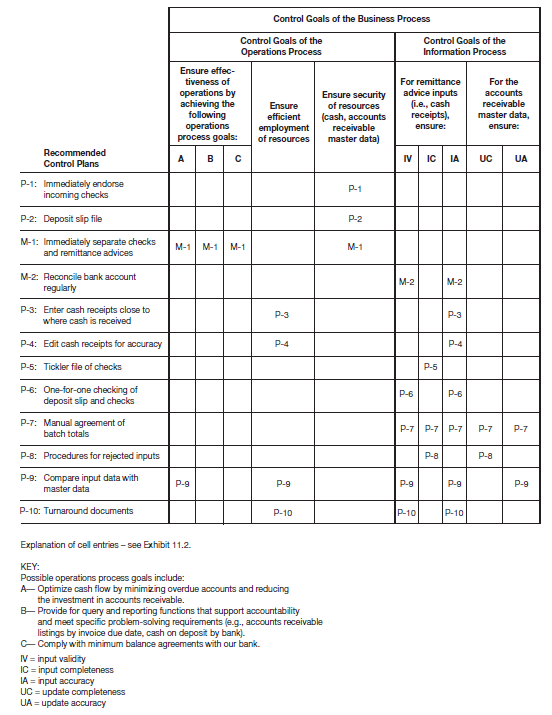

Each of the recommended control plans listed in the matrix is discussed in Table 12.3. We have intentionally limited the number of plans to avoid redundancy. As you study the recommended control plans, be sure to check where they are located on the systems flowchart. Note that Table 12.3 is divided into two sections: (A) Cash receipts process control plans that are unique to the cash receipts function, and (B) other control plans.

|

Review Question What controls are associated with the cash receipts function? Explain each control. |

|

A. Cash Receipts Process Control Plans P-1: Immediately endorse incoming checks. Security of resources: To protect the checks from being fraudulently appropriated, the checks should be restrictively endorsed (i.e., “For deposit only . . .”) as soon as possible following their receipt in the organization. Lockboxes provide even more protection for the cash by having cash receipts sent directly to a bank. P-2: Deposit slip file. Security of resources: By maintaining a completed deposit slip file, the cashier provides an audittrail to support each deposit, thereby protecting deposits from misappropriation. Should the deposit slip be filed prior to deposit, the validated deposit slip should be filed when it is returned from the bank. M-1: Immediately separate checks and remittance advices. Operations process goals A, B, and C: Checks should be separated from the remittance advices and deposited as quickly as possible. This helps to optimize cash flow and to ensure that the organization complies with minimum balance requirements of loan agreements with its bank. If remittance advices are immediately separated from checks, the process of recording the remittance advices is accelerated because customer payment is recorded at the same time that the deposit is prepared. Faster recording of the remittance advices (i.e., updating customer balances more quickly) helps to minimize overdue accounts and reduces accounts receivable. Furthermore, since the information available from the system stays up to date, this control also provides more meaningful query and reporting functions. Security of resources: The faster the checks are deposited, the less chance that the cash can be diverted. At a minimum, cash should be deposited once a day. M-2: Reconcile bank account regularly. Remittance advice input validity, Remittance advice input accuracy: By regularly reconciling the bank account, the organization confirms the validity and accuracy of the recorded cash receipts. The bank statement and validated deposit slips reflect actual cash deposits and the correct amount of those deposits. Ideally, a person who is independent of those who handle and record cash receipts and disbursements should perform the reconciliation. B. Technology-Related Control Plans P-3: Enter cash receipts close to where cash is received. Efficient employment of resources: The direct entry of cash receipts data by mailroom personnel provides for more efficient employment of resources because this arrangement eliminates costs associated with the handling of cash receipts data by additional entities. Remittance advice input accuracy: Because mailroom personnel have both the check and the paid billing statement (e.g., remittance advice), they are in a position to correct many input errors on the spot, thereby improving input accuracy. P-4: Edit cash receipts for accuracy. Efficient employment of resources: Programmed edits provide quick, low-cost editing of data. Remittance advice input accuracy: By identifying erroneous or suspect data and preventing these data from entering the system, programmed edit checks help to ensure input accuracy. P-5: Tickler file of checks. Remittance advice input completeness: The cashier should monitor the temporary file of checks to ensure that a deposit slip is received for all cash receipts. Because the deposit slip is prepared from the cash receipts data, this plan helps to ensure completeness of cash receipts inputs. P-6: One-for-one checking of deposit slip and checks. Remittance advice input validity: This plan helps to ensure input validity because each recorded receipt reflected on the deposit slip is represented by funds actually received (i.e., an actual customer check). Remittance advice input accuracy: Because the cashier compares details of the deposit slip to the checks themselves, the accuracy of remittance advice inputs is ensured. P-7: Manual agreement of batch totals. P-8: Procedures for rejected inputs. (Plans P-7 and P-8 were discussed in Table 12.2. Refer to that discussion for an explanation of the cell entries in the cash receipts control matrix.) P-9: Match input data with master data. Operations process goal A, Efficient employment of resources: Cash receipts data can be entered more quickly and at a lower cost if errors are detected and prevented from entering the system. Remittance advice input validity: The matching process verifies that any cash discounts deducted by customers have been authorized. Remittance advice input accuracy, Accounts receivable update accuracy: Comparison to the accounts receivable master data reduces input errors. Updates to the accounts receivable data occur simultaneously with input. P-10: Turnaround documents. Efficient employment of resources: The use of the billing statement as a turnaround document reduces data entry that must be completed. Only the amount paid needs to be manually recorded by data entry personnel. Performance of this function early in the process—before the check and statement have been separated—facilitates a more efficient correction of errors. Remittance advice input validity: By using the customer billing statement as the remittance advice, the turnaround document ensures the validity of the cash receipt source. Because we assume that the clerk enters the actual amount of the payment, we also know that the input amount is valid (supported by an actual payment). Remittance advice input accuracy: Scanning of the computer-readable turnaround document reduces the risk of data entry errors, thereby improving accuracy. |

- 5262 reads