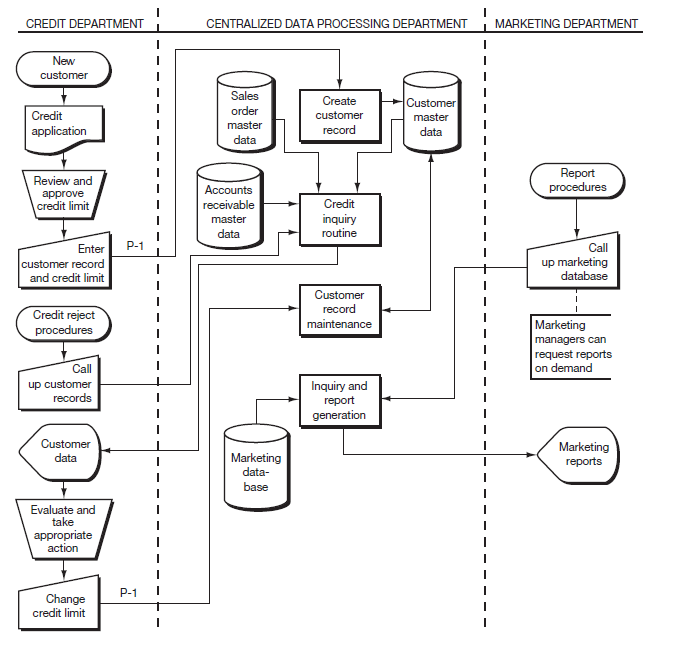

Figure 11.8 presents a systems flowchart of the model. Take some time now to examine the flowchart. On this first pass, please ignore the control annotations, P-1, P-2, etc. Controls will be covered in later sections.

|

|

Each field salesperson is provided with a laptop and a portable printer. The laptop is equipped with a modem that allows the salesperson to communicate with the centralized computer via 24-hour, toll-free, high-speed leased telephone lines. 1 With this type of direct access and the capabilities provided by order-taking software, a salesperson can perform a number of services for a customer, including the following:2

|

To illustrate typical process features, let’s assume that the salesperson invokes the option to process a sales order. The order might have been taken orally at the customer’s office or by telephone at the salesperson’s office. The first screen to appear generally contains information about the header section of the sales order form. Typically, the system automatically assigns sequential order numbers.

|

Review Question Does Figure 11.8 (a) employ online data entry; (b) use data communications technology; (c) process event occurrences individually, or in batches; and (d) update data records continuously? |

Then the system prompts the salesperson to enter the customer code. If the salesperson enters a customer code for which the system has no record, the system rejects the order, and recording of the event terminates. If the customer is new, the salesperson asks the customer to complete a credit application. The salesperson then forwards the application to the credit department. Next, a credit officer initiates a credit investigation, resulting in either credit approval (usually with a dollar ceiling) or credit denial. Figure 11.10 illustrates these procedures.

Assuming the salesperson enters a valid customer code, the system automatically retrieves certain standing data, such as customer name(s), address(es), and credit terms, from the customer data. Next, the salesperson enters the other data in the sales order header, guided by the cursor’s moving to each new position in the preformatted screen.

After the user completes and accepts the header section, the PC displays the middle section of the sales order (i.e., sales order lines). The salesperson enters data for each item ordered, starting with the part number. The system automatically displays the description and price.

Finally, the salesperson enters the quantity ordered and the date the customer needs the goods. If the total amount of the current order, any open orders, and the outstanding receivable balance exceeds the customer’s credit limit, the operator is warned of this fact, the order is suspended, and credit rejection procedures are initiated. If the total amount falls within the customer’s credit range, processing continues. Should the balance shown on the inventory data be less than the quantity ordered, back order procedures commence.

Once the salesperson finishes entering the order data, the computer updates the sales order master data, the inventory master data, the shipment event data, and the sales commission data and produces an exception and summary report. A two-part customer acknowledgment prints on the salesperson’s portable printer; the original is left with (or mailed to) the customer to confirm the order, and the duplicate is retained by the salesperson. Simultaneously, a three-part sales order and sales order (SO) bar code labels (BCLs)—containing the sales order header information—are printed and distributed. Note that the distribution of these documents is similar to that shown on the data flow diagrams presented earlier and in Appendix 10A.

The warehouse layout is optimized to facilitate order picking. Each item in the warehouse has a ticket attached to it that contains the product bar code as well as its printed identification code and product description. We call this a BCT—bar code ticket—in the flowchart. As the items are picked, the stub of each BCT is removed as that item is packaged in a shipping carton—several items are contained in each carton. One of the sales order bar code labels (BCL) is pasted to the outside of the carton, and the individual BCTs are temporarily stapled to the carton as well. When the entire order has been picked, warehouse personnel insert the picked quantities on the picking ticket, initial the ticket, and then move the goods and the completed picking ticket to the shipping department.

Shipping personnel compare the goods to the completed picking ticket and their copy of the packing slip. Then, they scan each carton’s BCL and the individual product BCTs that comprise that carton. The scanning process automatically prints a two-part bill of lading and a shipping notification on a printer located in the shipping department and simultaneously updates the shipping notice data and sales order master data to reflect the shipment. The goods themselves plus the original of the bill of lading and the completed packing slip are given to the carrier for delivery, and the shipping notification is sent to the billing section of the accounts receivable department. The bill of lading duplicate, completed picking ticket, and product BCTs are filed in the shipping department.

Consider how the M/S process documented in Figure 11.8 might change in an enterprise system environment. After you have thought through the impact and the resulting changes to Figure 11.8, read Technology Insight 10.3, which provides an overview of how a fully implemented enterprise system impacts the M/S process discussed in this chapter.

|

|

Other aspects of the process can also benefit from automation. For example, as mentioned in Business Intelligence and Knowledge Management Systems, expert systems are being used increasingly in practical business applications, including M/S processes. To illustrate, the American Express Company has developed an expert system called Authorizer’s Assistant that helps the credit authorization staff to approve customer charges. The Authorizer’s Assistant searches through 13 databases and makes recommendations to the person making the authorization decision. Authorizer’s Assistant raises the user’s productivity by 20 percent and reduces losses from overextension of credit. In addition to cost savings, this expert system application allows American Express to differentiate itself from its competition by offering individualized credit limits. |

- 5464 reads