|

|

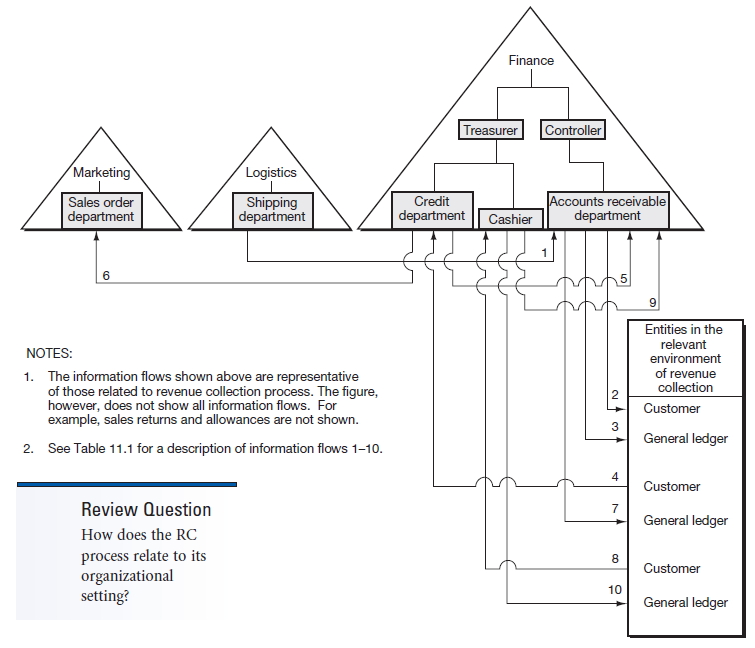

Figure 12.2 presents a horizontal view of the relationship between the RC process and its organizational environment. Like its counterpart in THE “ORDER-TO-CASH” PROCESS: PART I, MARKETING AND SALES (M/S), it shows typical information flows handled by the RC process. The flows provide an important communications medium among departments and between departments and entities in their relevant environment. The object here is simply to have you identify the major information flows of the RC process. Technology Insight 11.1 discusses how horizontal information flows in an enterprise system become automated and therefore more efficient in terms of supporting the RC process. |

|

Flow No. |

Description |

|

1 |

Shipping department informs the accounts receivable department (billing section) of shipment. |

|

2 |

Accounts receivable department (billing) sends invoice to customer. |

|

3 |

Accounts receivable department (billing) informs general ledger that invoice was sent to customer. |

|

4 |

Customer, by defaulting on amount due, informs credit department of nonpayment. |

|

5 |

Credit department recommends write-off and informs accounts receivable department. |

|

6 |

Credit department, by changing credit limits, informs sales order department to terminate credit sales to customer. |

|

7 |

Accounts receivable department informs general ledger system of write-off. |

|

8 |

Customer makes payment on account. |

|

9 |

Cashier informs accounts receivable department (cash applications section) of payment. |

|

10 |

Cashier informs general ledger of payment. |

|

*Many of these steps may be automated. See Technology Insights 11.1 and 11.3 for descriptions of these steps in an enterprise system implementation. |

|

TECHNOLOGY INSIGHT 11.1

Enterprise System Support for Horizontal Information Flows

The information flows presented in Figure 12.2 are very similar to what we would expect if the organization were using an enterprise system. However, many of the tasks outlined would occur quite differently because of the messaging capabilities embedded in contemporary enterprise systems. Let’s take a look at each of the information flows in Figure 12.2.

- The flow of information from the shipping department to the accounts receivable department (billing section) is an automatic trigger from the enterprise system. As soon as the shipping department enters the shipment into the enterprise system, a message is sent to the billing module in preparation for step 2. If necessary, a message of the update could also be routed to the accounts receivable department.

- As a regularly scheduled event, the billing department uses the enterprise system to generate an invoice and transmit the invoice to the customer either by mail or electronically.

- The generation of the invoice (step #2) automatically updates the accounts receivable balances in the general ledger portion of the enterprise system.

- Periodic reports are generated based on lack of customer payment and trigger a credit hold on the account. A message is also automatically routed to the credit department to review the account.

- As a regularly scheduled event, the credit department reviews accounts and determines when accounts should be written off. A message is routed to the accounts receivable department authorizing a write-down, and accounts receivable confirms.

- As a regularly scheduled event, the credit department reviews and revises credit for customers and changes are automatically made to the credit data accessible by the sales order department.

- Authorization of write-down in flow #5 by the accounts receivable module automatically updates general ledger balances.

- Customer payment is received either by mail or electronically.

- Cashier records payment into the enterprise system and the accounts receivable balances are updated. Accounts receivable instantly has updated information.

- Recording of payment by cashier (step #9) automatically updates general ledger balances.

As is apparent, much of the processing of information flows becomes simply automatic updating of relevant data stores. These automatic updates occur because of the integrated nature of the enterprise system and its underlying database. If the information needs to draw the attention of another person, automatic messaging systems can automate the notification process as well.

Next, we introduce the key “players” shown within the “Finance” entity of Figure 12.2 (i.e., those boxes appearing in the right-most triangle of that figure). As illustrated by the figure, the major organizational subdivision within the finance area is between the treasury and controllership functions. Most organizations divorce the operational responsibility for the security and management of funds (treasury) from the recording of events (controllership). In other words, the treasurer directs how the company’s money is invested or borrowed (i.e., an external focus), and the controller tracks where sales and other income comes from and how it is spent (i.e., an internal focus). The pervasive control plans (see IT Governance: The Management and Control of Information Technology and Information Integrity) of segregation of duties and physical security of resources motivate this division between the treasury and the controllership functions.

Within the treasury function, the activities having the greatest effect on the RC process relate to the credit manager and the cashier. First, note that the credit manager is housed within the finance area rather than within marketing. This separation of the credit and sales functions is typical. If the credit function were part of marketing, credit might be extended to high-risk customers simply to achieve an optimistic sales target.

It is important also to separate the credit function (event authorization) from the recordkeeping functions of the controller’s area. Within the controller’s area, the major activities involved with the RC process are those of the accounts receivable department. This functional area is primarily involved in recordkeeping activities.

- 5125 reads