The warning the United States gave the world in 1968 triggered a number of attempts to save the fixed exchange rate system. To provide some international liquidity, the IMF issued what it called special drawing rights (SDR). The SDR is an international reserve asset, sometimes called paper gold, issued by the IMF and distributed to its members. SDRs can be used by IMF members to obtain a specific currency, settle a financial obligation, or secure a loan. The SDR was originally linked to gold. In 1974 SDRs became linked to a collection of five currencies-the U.S. dollar, the German deutsche mark, the British pound, the French franc, and the Japanese yen. By 1988 the average value of the SDR was $1.33, and SDRs accounted for only 10% of the total international reserves, excluding gold holdings.

In the early 1970s, the European countries attempted to stabilize their currencies by creating the European Monetary Union (EMU). The members of the EEC plus the United Kingdom and Denmark agreed that they ,would limit fluctuations among their currencies to within a small range, but that the value of the group of currencies as a whole could fluctuate against that of other currencies. Successive improvements of this initial scheme led to the development in 1979 of the European Monetary System (EMS).

All of these developments by the IMF and the EEe led finally to the total abandonment of the fixed exchange rate system in 1973. Obviously, the completely free floating system that followed the breakdown of the fixed exchange rate system could not continue to operate indefinitely. Free floating implies that the price of one currency relative to another is determined entirely by the daily market forces of demand and supply and not by the government of any country. In reality, most currencies are fixed in that they are tied to another currency, usually the currency of the country's major trading partner.

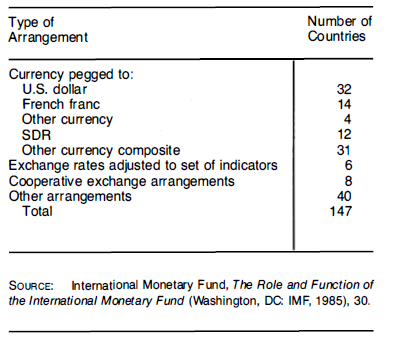

In April 1976, the IMF's Board of Governors approved a number of amendments to the IMF articles of agreement that legitimized the changes that had taken place, a move that led to official acceptance of the managed float system. Under the managed float system, the major industrialized countries' currencies float more or less freely against each other. The smaller countries peg their currencies to one of the major currencies. Most of the small countries peg their currencies to the U.S. dollar, the British pound, the Japanese yen, the Canadian dollar, or the French franc. (See Figure 8.4)

The managed float system has substantially reduced the role of the IMF. The major countries have no need for it as a currency regulator, and the minor countries usually usit primarily as a consultant on international monetary reforms that have to be instituted to secure financial assistance from the major commercial banks.

In sum, after going through numerous changes over the past decade, the International Monetary System is in no better position today to guarantee financial stability in the international market that it was ten years ago. The good old days of the gold standard and the fixed exchange rate system seem to be gone forever.

- 2025 reads