Designing a fair compensation system is one of the touchiest issues in international human resource management. It is difficult to establish a salary scale that will motivate employees in one country without discouraging those in another country. In addition to fluctuations in exchange and inflation rates and differences in the costs of living in different countries, the compensation system must take into account the cultural, political, and economic shocks that most employees experience upon taking on jobs in foreign countries. Thus a compensation system for overseas assignments must cover not only the salaries of PCNs, HCNs, and TCNs, but also how the company will ease the transition both for managers sent abroad and for managers brought back home.

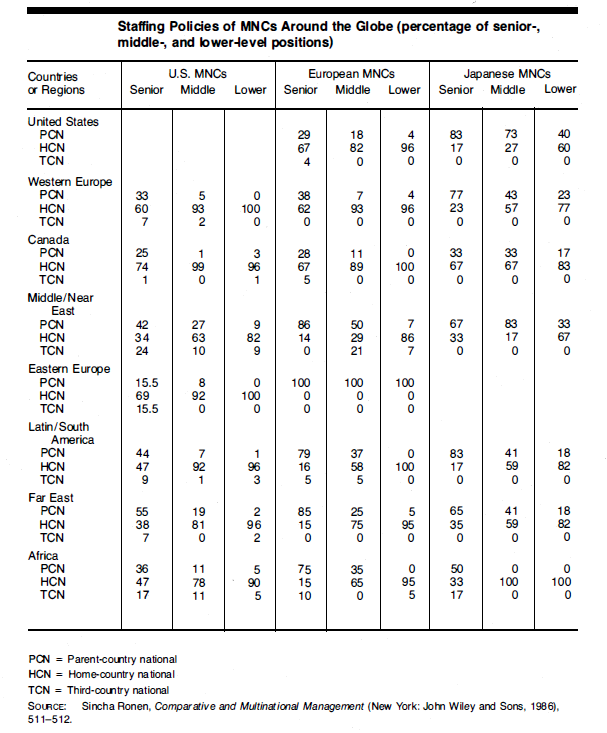

Most companies set the salaries of parent-country-national and third-country-national management at more or less the same level. With respect to host country nationals, however, the MNC must obey the wage and salary guidelines issued by the host-country for local firms. In some cases, MNCs have been known to be extremely "creative" in devising ways of compensating their managers, especially top management personnel.

The vast majority of MNCs design a single compensation system for all home-country nationals working overseas. Such a system usually is made up of the following components: 1

(1) Base salary tied to salary range for comparable domestic position.

(2) Premiums and inducements to work abroad. Such premiums are offered to encourage mobility and to compensate employees for the hardships of living abroad.

(3) Allowances designed to permit those assigned to foreign posts to maintain their previous lifestyles. The most common of such allowances are for cost of living, housing, education, and tax protection.

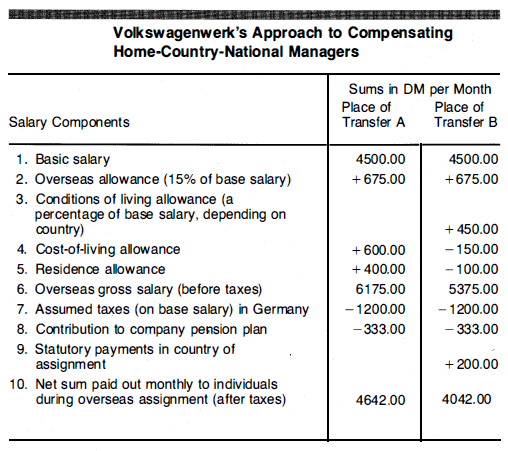

Figure 15.4 illustrates the so-called balance sheet approach used by Volkswagenwerk, the well-known German auto company with subsidiaries in various countries, including Belgium, France, Brazil, Mexico, the United States, Canada, and South Africa.

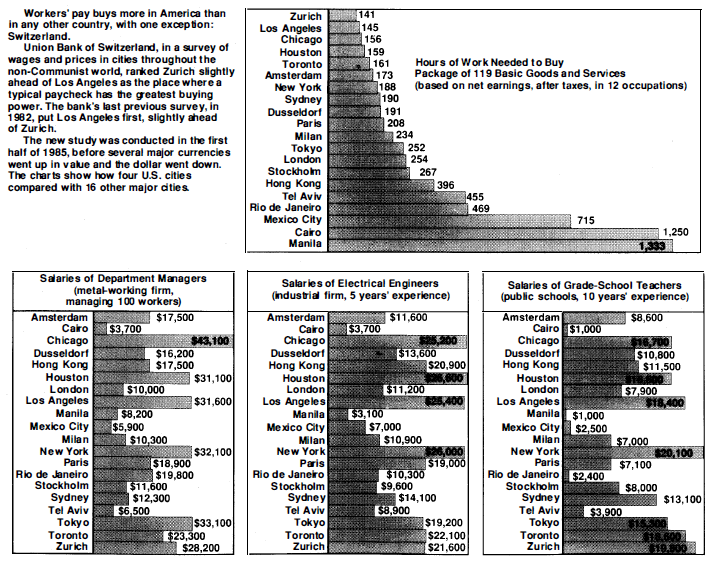

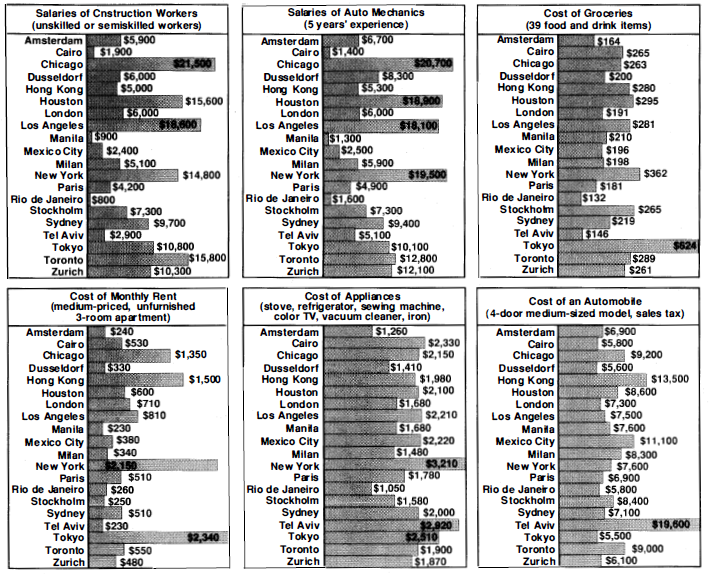

The kinds of data needed by a personnel director charged with designing an international compensation package for a given type of worker are shown in Figure 15.5 and Figure 15.6 Such data can be obtained from a number of sources. Every three years the Union Bank of Switzerland (UBS) publishes a booklet called Prices and Earnings Around the Globe, which contains very detailed data on cost of living and wages and salaries for some forty-nine cities throughout the world. Towers, Perrin, Foster and Crosby, a consulting group headquartered in New York, and the U.S.-based Wyatt Actuaries and Management Consultants (in conjunction with its subsidiary, Executive Compensation Services, in Brussels ) offer their services all over the world. The Hays Group maintains offices in virtually every country of the world, providing job classification and compensation systems for both hourly employees and executives.

An important problem that should be addressed in designing a compensation policy is how to minimize the economic shock experienced by returning employees upon the discontinuation of the premiums and allowances of the overseas package. Overseas executives generally suffer an economic "letdown" upon returning to the home country. Although this letdown is more pronounced for executives who return to a country with a high inflation rate and a weak currency (for example, executives returning to England or the United States from West Germany or Japan), most executives find that their new salaries do not allow them to live up to the standards they became accustomed to during their overseas tour. The premiums, allowances, and other "perks" associated with overseas assignments, such as generous expense accounts for home and office entertainment, may be greatly missed by the returning executive.

SOURCE: Peter Frerk, "International Compensation: A European Multinational's Experience," The Personnel Administrator 24 (May 1979): 33. Reprinted with permission from the May 1979 issue of Personnel Administrator, copyright 1979, The American SOciety for Personnel Administration, 606 North Washington Street, Alexandria, VA 22314.

States from West Germany or Japan), most executives find that their new salaries do not allow them to live up to the standards they became accustomed to during their overseas tour. The premiums, allowances, and other "perks" associated with overseas assignments, such as generous expense accounts for home and office entertainment, may be greatly missed by the returning executive.

MNCs use several procedures to minimize this shock. One approach is the so-called allowance phaseout, in which the overseas allowance is phased out while the employee is still overseas, the assumption being that after a certain number of years in a given location managers and their families adjust to the local cost of living and do not need the extra allowance. Another approach is the Single-payment mobility premium. This approach ties the premium to the move instead of to the assignment. In other words, the executive receives a premium each time he or she is assigned to a new location, whether it is in the home country or overseas. As a rule, single-payment mobility premiums tend to encourage moves, thereby making it easier for the company to staff new or upgraded positions across the globe. Permanent additions to income tend to discourage all but the initial move, thereby decreasing the probability that a competent executive will be willing to move to a new location where the "perks" are not at the same level or even better.

SOURCE: Pictogram, "Paycheck Power-From Houston to Hong Kong," U. S. News & World Report, October 28, 1985. Copyright, 1985, U.S. News & World Report. Reprinted from issue of October 28, 1985.

- 2714 reads