In the preceding section the basic international business transactions were explained using the concept of a country as an autonomous, sovereign state capable of making all the decisions necessary to carry out these economic transactions. In reality, however, countries or nations do not engage directly in any of the main activities of international business. Rather, the agent or main actor in this transnational interplay is private enterprise or mixed enterprise (private enterprise with substantial governmental participation).

The nature, structure, strategies, and role of private international enterprise are dealt with in THE MULTINATIONAL CORPORATION. Here a brief explanation of the process of the internationalization of business enterprises is presented.

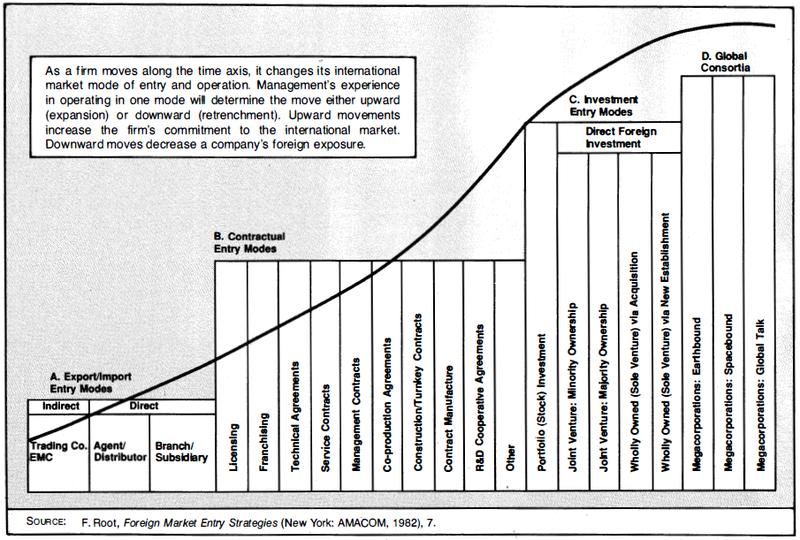

This book espouses the evolutionary theory of international business. According to this theory, firms become involved in international business by following a stepwise process. 1 This process represents a gradual involvement in international business, which begins with exporting and ends with direct foreign investment. The process is pictured in Figure 2.2. As the firm moves from left to right along the globalization line, it proceeds through several phases. Each step prepares the way for the next step.

In general, the potential benefits and risks for the firm increase as it upgrades its international involvement. Thus, the springboard, or base, of the stepwise globalization program (A. Export/Import Entry Modes) represents the lowest risk and, of course, the lowest control and benefit from international business activity. At the third step of the internationalization process (C. Investment Entry Modes), the opposite is true: the high benefits and control carry with them a rather substantial risk. Finally, at the extreme end of this process (D. Global Consortia Modes), the firm engages in "competitive cooperation" in the sense that it enters into "friendly ties" (agreements with competing firms and/or nation-states) and forms "strategic alliances." 2

Once started in international business, a company will gradually change its entry mode decisions in a fairly predictable fashion. Increasingly, it will choose entry modes that provide greater control over foreign marketing operations. But to gain greater control, the company will have to commit more resources to foreign markets and thereby assume greater market and political risks. Growing confidence in its ability to compete abroad generates progressive shifts in the company's trade-off between control and risk in favor of control. Consequently, the evolving international company becomes more willing to enter foreign target countries as an equity investor. 3

Of course, not all companies will follow this evolutionary, or graduated-commitment, type of strategy in going international. The model is, however, generally applicable, as traditionally most multinational companies have internationalized their business activities by moving along the export-wholly owned investment continuum. In general, a company will entertain the idea of going international for essentially two types of reasons: 4

- Operational Necessities

- To secure raw material

- To secure equipment

- To secure technology

- To dispose of excess output

- Strategic Necessities

- To assure its invulnerability to future changes in its external environment

- To assure continued growth by

- sustaining historical growth patterns

- avoiding stagnation caused by saturation

- increasing the volume of business

- increasing the rate of growth

- To assure and improve profitability

Although the emphasis in this book is on strategic management, keep in mind that strategic management concepts, once implemented, become operational necessities. For this reason, it is more appropriate to think of operational and strategic activities as interrelated and interdependent rather than as separate and discrete managerial functions.

A look at Figure 2.2 reveals four interrelated and identifiable phases:

Phase A: Export/Import Entry Modes

Phase B: Contractual Entry Modes

Phase C: Investment Entry Modes

Phase D: Global Consortia

A full description of the logic and managerial involvement in each of these modes will be given in PARTICIPATION STRATEGY; only a brief introductory explanation is provided here.

- 4899 reads