Suppose that a firm in the United States ships merchandise to an overseas buyer with the understanding that the price of $50 million, including freight, is to be paid within 90 days. In addition, assume that the merchandise is transported on a U.S. ship.

In this case U.S. residents are parting with two things of value, or two assets: merchandise and transportation service. (Transportation service, like other services supplied to foreigners, can be viewed as an asset that is created by

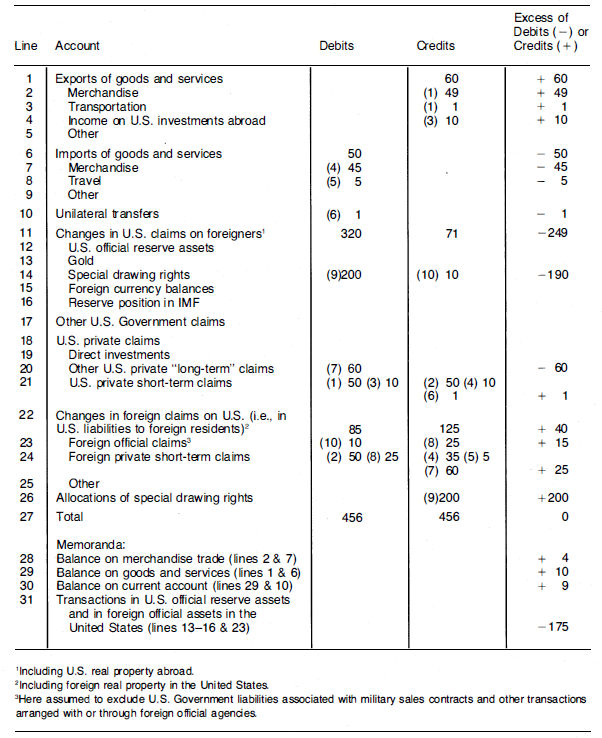

U.S. residents, transferred to foreigners, and consumed by foreigners all at the same time.) In return for giving up these two assets, U.S. residents are acquiring a financial asset, namely, a promise from the foreign customer to make payment within 90 days. In accordance with the principles outlined above, the bookkeeping entries required to record these transactions are as follows: ( 1 ) a debit of $50 million to the account "U.S. private short-term claims," to show the increase in this kind of asset held by U.S. residents; (2) a credit of $49 million to "Merchandise," and (3) a credit of $1 million to "Transportation," to show the decreases in these assets available to u.s. residents. These figures are entered on lines 21, 2, and 3 in Figure 8.8 and are preceded by the number ( 1 ) in parentheses to indicate that they pertain to the first transaction discussed.

- 1574 reads