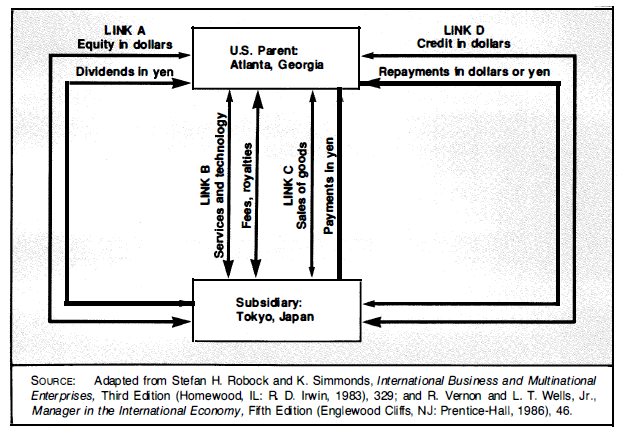

In an MNC with many subsidiaries, both the money for the purchase of inputs and the money from the sale of outputs may come from within the MNC. In general, financial exchanges between an MNC and its subsidiaries, as well as those between subsidiaries, take one of the following forms (see Figure 12.1):

Link A: Investment or equity (dividends)

Link B: Services and technology (fees and royalties)

Link C: Merchandise or goods (accounts payable)

Link D: Credit or loan repayments (principal and interest)

The links go both ways-from the parent to the subsidiary and from the subsidiary to the parent. The direction indicated by the larger arrowhead, however, is much more likely than the one indicated by the smaller arrowhead. For example, it is much more common for a parent to make an equity investment in a subsidiary than for a subsidiary to make an equity investment in the parent.

As Figure 12.1 indicates, transfers from the parent to the subsidiary are denominated in the currency of the parent company (in the hypothetical case illustrated in the exhibit, dollars), and returns to the parent from the subsidiary are denominated in the subsidiary's currency (for example, yen). This factor is a critical one in international financial management.

Managing and keeping track of interaffiliate transactions is a very complex process. Some observers fail to see the need for any record keeping and managing of these activities. "After all," they argue, "it's all in the family." This is true-it is all in the family. There are, however, many reasons why clear, meticulous, and consistent records must be kept. These reasons stem from the nature of the claims the MNC's various stakeholders have on its resources and outputs.

First, of course, there is the MNC itself. Headquarters must estimate fairly accurately each subsidiary's performance in order to determine whether the operation is achieving the goals set for it. Second, there are the home country taxing authorities. Profits' of the MNC's subsidiaries, even though they are generated in the four corners of the world, are taxable at home. So the headquarters' consolidated balance sheets and profit and loss statements must include all the financial activities of the MNC's subsidiaries. Third, there are the host country, taxing authorities. Every subsidiary of an MNC operating within the sovereign jurisdiction of a foreign country is subject to taxation by that country, just as any domestic corporation is (except the tax havens of Bahrain and Liechtenstein). Finally, there are the stockholders. Some MNC subsidiaries are engaged in joint ventures with either local companies or other MNC subsidiaries. Profits generated by these subsidiaries serve as the basis for the declaration and distribution of dividends.

These demands, both external and internal, necessitate a rather complex and costly process of recording, reporting, and evaluating the results of managerial activity all over the globe. This process creates a number of problems for the MNC manager, but at the same time it provides numerous opportunities for global transferring of financial and other resources from one subsidiary to another and from the subsidiaries to the parent company so as to minimize foreign exchange risks and taxes.

The task of the international financial manager of an MNC is a very complex one. For this reason it is recommended that a systems approach be used in setting up the financial systems and procedures for an MNC. A complete description of such an approach will be presented in COMMUNICATION AND CONTROL when the subject of control and communication is considered. Here a brief description is offered.

- 2417 reads