The formal organization structure shows MNC employees the routes that organizational decision making theoretically must follow. It may or may not provide a clue to the locus of the authority to initiate the decision-making process. Where the majority of the decisions are made (at the headquarters level, the regional level, or the national subsidiary level) will depend on the company's attitude toward the question of centralization vs. decentralization of decision making.

Despite the voluminous research on the subject of the distribution of decision making, no single theory conclusively proves the superiority of either centralization or decentralization. Instead, a sort of "relativity" theory seems to govern decision making. The appropriate degree of centralization or decentralization depends on a number of factors, such as

- The weight of the decision to be made in terms of its impact on the overall company

- The speed with which the impact will be felt by the MNC

- The ease and cost of reversibility

- The nature and timing of the decision

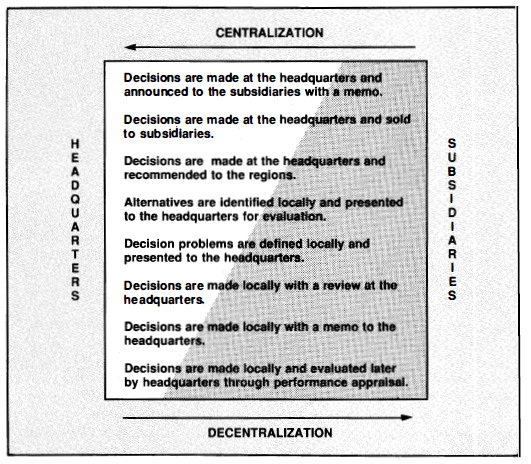

Figure 11.7 illustrates the possible ways that decision-making prerogatives can be shared between the headquarters of an MNC and its foreign subsidiaries. The shaded area indicates the proportion of the decision-making authority held by the subsidiaries. As one moves from top to bottom, the amount of decision making authority held by the subsidiaries increases. Note that in no case does the decision-making authority of either party reach zero. Thus, at the level of greatest decentralization, decisions are made by the local subsidiary and then evaluated by headquarters through a performance appraisal at the end of the year or other prearranged intervals. At the next level, the local manager makes the decision and informs the headquarters in a memo. At the other extreme, decisions are made at the headquarters and communicated to the subsidiaries via a memo. In between these two extremes one could arrange hundreds of possible combinations of shared decision-making privileges.

Most financial decision making is centralized, for financial decisions generally have an immediate impact on the entire company and are extremely difficult to reverse. Likewise, expensive R&D projects are usually centralized. Most MNCs resist decentralizing their R&D activities. (For example, IBM pulled out of India and Mexico when their governments insisted on setting up R&D facilities in their countries. )

Decision making about production, marketing, and logistics, on the other hand, is usually decentralized, because problems in such areas require immediate solutions. The need to wait for headquarters to make or approve these types of decisions can severely and unnecessarily constrain managerial effectiveness.

- 2052 reads