In INTERNATIONAL FINANCE, the term "exchange rate" was defined as a ratio expressing the value of one currency in terms of another. When the exchange rate between, for example, the British pound (£ ) and the u.s. dollar ($) is 1.6050, it takes $1.6050 to obtain one British pound. Although exchange rate fluctuations are common, they are not easy to understand or to predict. In general, there are three main exchange rate determinants:

- The rate of price increases in a country (inflation)

- The degree of economic activity (economic growth or stagnation)

- The cost of money (interest rates)

The manager's task is to understand the forces that directly or indirectly affect exchange rates; assess the potential impact of these forces in terms of magnitude, likelihood, and timing; and devise means to protect the firm's assets from possible losses emanating from exchange rate fluctuations. In brief, the manager's job is the minimization of the company's exposure to exchange rate risk.

Although practitioners and academicians have been studying exchange rate risk for years, there is no consensus as to how to measure and manage it. 1 This section will give a brief introduction to measuring and managing exchange rate risk. More detailed treatments can be found in the sources listed at the end of the chapter.

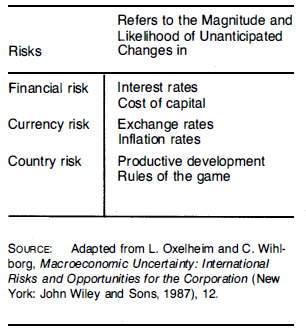

As used in international finance, risk is a measure of the potential magnitude and the likelihood of unanticipated events. This definition of risk suggests the approach the international financial manager should take to evaluating exchange rate risk. First, the manager should concentrate on unanticipated events. Events that can be anticipated are presumably accounted for in the company's planning process. Second, the manager must make an effort to provide estimates of the magnitude of the events that may occur. Third, the manager must provide estimates of the probability (likelihood) of these events.

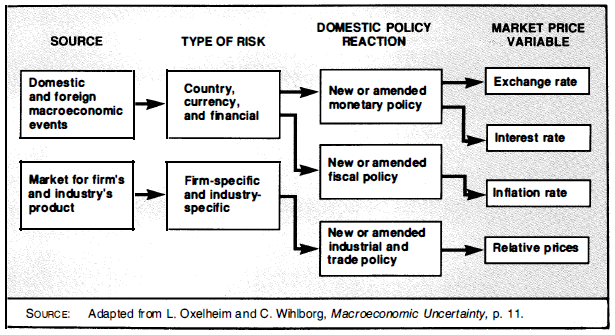

In evaluating the exchange rate risk to the firm's daily cash flows and final value, an international financial manager must look at

- The macroeconomic structure

- The policy regime followed by authorities in the home and host countries

- The nature of the firm's assets

In examining the macroeconomic structure, the manager should concentrate on the three exchange rate determinants-inflation, economic growth (expansionary or contractive economic policy), and changes in interest rates. The impact of governmental policies on these factors then must be anticipated. Finally, the sensitivity of the firm's assets to any disturbances in exchange rates must be assessed.

The bulk of a financial manager's time is spent protecting the firm from potential harmful effects of exchange rate changes on its liquidity, profitability, and value. Three basic measures of exchange rate exposure are

- Transaction exposure

- Translation exposure

- Economic exposure

Transaction exposure derives from uncertainty about the value in domestic currency of a specific future cash flow in a foreign currency. Thus, this type of exposure arises in the daily transactions between MNC subsidiaries and between each subsidiary and the headquarters. Most of these transactions are contractual-they take the form of agreements between one subsidiary, or one customer, and another to buy and sell products and/or services. In terms of the standard accounting recording, most of these transactions are reflected in the current assets portion of the balance sheet.

Translation exposure relates to the net balance sheet in foreign currency. Translation exposure is basically an accounting concept, as it is not felt until (or unless) the firm merges its activities into one consolidated balance sheet at the end of the reporting period, usually quarterly or annually. For all practical purposes, then, translation exposure is a latent risk which becomes real when and if the firm either consolidates at the end of the period or liquidates. Translation gains and losses due to exchange rate fluctuations have no cash flow effect; they are not realized over the reported period.

Economic exposure refers to the sensitivity of the firm's economic value to changes in exchange rates. The economic value of the firm depends, of course, on its expected ability to produce cash flows in the future. Usually, economic exposure does not come into question unless the firm is up for sale. Only very infrequently will a financial manager be asked specifically to protect the firm against economic exposure. Good transaction and translation exposure management should suffice to minimize the negative impact of exchange rate fluctuations on the value of a firm.

- 2367 reads