The most commonly used nontariff barrier is the quota. A quota specifies the maximum amount of a good that may be brought into a country from abroad per unit of time. It is, in other words, a legal limit on the amount of a good that may be imported. Another commonly used nontariff barrier is the export subsidy. An export subsidy is a payment by a country's government to an exporter. This payment can take the form of a premium, a tax credit, or lower interest payments on loans made specifically for export production. Most countries that use export subsidies employ a combination of the above. In addition, paperwork, permits, quality verification, customs declarations, and other bureaucratic procedures can become much more effective nontariff trade barriers than any of the above-mentioned methods.

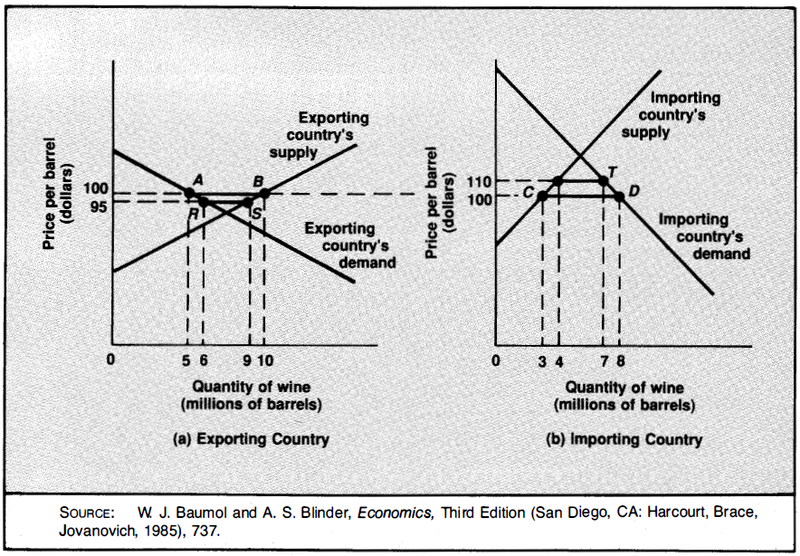

Figure 7.4 illustrates the market adjustments that take place as a result of the imposition of a tariff and a quota. As the exhibit shows, both trade regulation methods have the same effect: a reduction in the quantity of a product imported. In the example illustrated, the equilibrium price of wine under free trade is $100 per barrel. At that price, the exporting country will send five million barrels of wine to the importing country. This exchange is represented by distance AB in part (a) and distance CD in part (b). If a quota of three million barrels is imposed by the importing country, the distance must shrink to three million barrels: distance RS for exports in part (a) and distance QT for imports in part (b). Exports and imports must remain equal, but the quota will force prices to be unequal in the two countries. Wine will sell for $110 per barrel in the importing country but for only $95 per barrel in the exporting country. A tariff achieves the same result in a different way. It requires that the prices in the two countries be $15 apart. As the graph shows, this requirement too dictates that exports and imports be at a level of three million barrels.

- 2650 reads