Morris was a manufacturer of "supermini" computers based in Hackettstown, New Jersey. It had gone international a long time ago and by 1983 about two-thirds of its revenues were earned outside the United States. Morris (USA) entered the Brazilian market in 1971 by assembling and distributing computers in Belo Horizonte, in the state of Minas Gerais. Late in the 1 970s, after it became known for the high quality · of its products, Morris (USA) expanded its operations in Brazil to manufacture and distribute a line of superminis, which included a full line of disk drives, printers, and other peripherals. Sales in Brazil focused on medium-sized enterprises, foreign and domestic, and were made on a revolving and installment credit basis. Such sales had amounted ( excluding financial charges) to 36,246 million cruzeiros ( Cr $ ) in fiscal year 1 982, 86,593 million cruzeiros in 1983, and 1 58,9 1 6 million cruzeiros in 1 984 ( Figure 12.14 ). Morris was beginning to feel the pinch of competition from the North American minicomputer manufacturers, who, having been excluded from the Brazilian market in their principal products by severe import controls, had moved aggressively into the one segment, halfway between minis and mainframes, that remained the principal domain of foreign producers.

Past experience in several countries, including the United States, had shown that the availability of credit was fundamental to maintaining a market position. This aspect was even more important in Brazil, where companies frequently incurred indebtedness in the hope of benefiting fr om the chronically high inflation rate. Therefore, to assure sales, Morris de Minas would need to extend its investment in receivables fr om time sales for the foreseeable future.

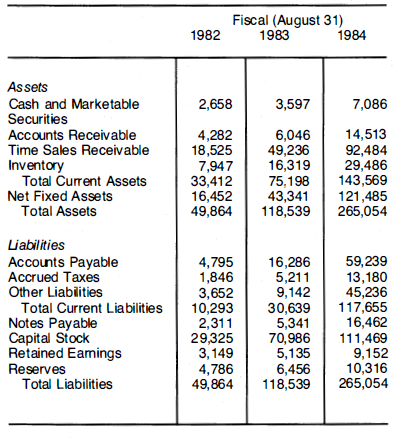

Until recently, Morris (USA) had fo llowed a policy of financing its growth almost entirely fr om its own cash flow without resort to external borrowing. For subsidiaries operating in countries with high inflation rates and soft currencies, that policy had sometimes led to heavy fo reign exchange losses, as reflected in Morris de Minas' profitability in years 1982 and 1983, when equity was by far the most significant source of the affiliate's funds (Figure 12.14 and Figure 12.14 ). However, during the fall of 1983, in a move aimed at limiting exposure to exchange losses, Morris (USA) management had set new equity participation limits for all subsidiaries potentially subject to high fo reign exchange risk. According to the new policy the parent company would commit equity capital to its Brazilian affiliate only to the extent of 20 percent of its present working capital needs. The implication was that Morris de Minas would have to obtain Cr $66, 120 million fr om outside sources in this instance.

David Albuquerque, the vice-president of finance for the Latin American Division, was in charge of exploring possible financing arrangements and preparing a financing plan. Albuquerque realized that both the Brazilian expected inflation rate and tax legislation, as well as the future behavior of the exchange rate, would play major roles in his analysis. These were difficult to predict; nevertheless he regarded this as a good opportunity to stack up the company's linancing choices against one another in a systematic fa shion and perhaps also to give some thought to the total financial structure of the Brazilian subsidiary ....

- 1761 reads