1Direct foreign investment (DFI) is the foreign market entry strategy requiring the most commitment from a company. When a company decides to invest capital in assets in a foreign country, its management has come to the conclusion that it will play the international business game for keeps. The decision to invest in physical assets (or, as these assets are commonly called, "bricks and mortar" ) is usually preceded by a great degree of deliberation and evaluation of a company's past experience with other, less extensive modes of operation in a foreign country (such as exports, imports, and contractual agreements ).

As we have seen, the 1970s and 1980s witnessed a remarkable reversal of the United States' role in the foreign investment game. The country changed from the major investor in foreign countries to a major recipient of foreign investment. While U.S. direct foreign investment abroad increased by a small amount (about 21 % between 1980 and 1986), direct foreign investment in the United States more than doubled (from $83 billion to $209 billion). These foreign investments in the United States provided employment to almost three million people (about 3% of the total work force) 2

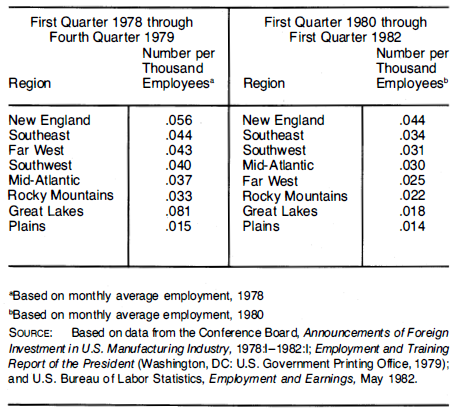

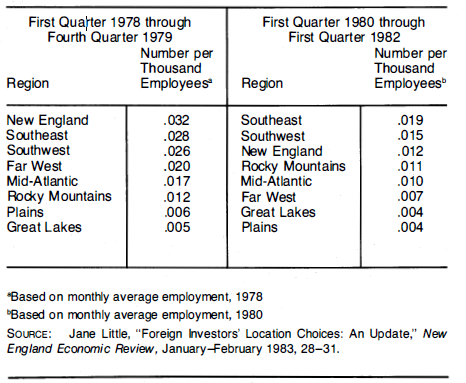

Not surprisingly, trends in direct foreign investment in the United States follow social, economic, and industrial trends in the country. During the last two decades the United States experienced a massive shift of activity away from the Northern and Northeastern states and toward the Southeastern and Southwestern states. Indeed, statistics show that the Southeastern states received the lion's share of DFIUS. Figure 5.3 Regions Ran ked by Number of Foreign... and Figure 10.5 provide data on the regional shares of DFIUS, using as a measure the number of investment projects per thousand manufacturing employees. As Figure 5.3 Regions Ran ked by Number of Foreign... shows, the Southeast ranks second among U.S. regions in the number of foreign manufacturing constructions and acquisitions experienced during the period shown. When only new construction is considered, the Southeast is in first place for the latter part of the period ( as shown in Figure 10.5). Although the New England region attracted the most DFIUS, the foreign capital invested there was for acquisition of existing facilities rather than for creation of new facilities and therefore new workplaces.

The implications of this shift toward investment by foreigners in more new construction in the Southeastern United States are tremendous, and it is no wonder that the competition among these states to attract foreign investment has increased tremendously. Governors are organizing foreign missions in collaboration with chambers of commerce, state and federal industry and trade offices, and other public and private interest groups. Political figures and even entertainment personalities have helped these efforts by using their contacts to set up meetings with their counterparts in foreign countries.

- 2173 reads