Transfer prices are the prices an MNC subsidiary charges a sister subsidiary for goods and services. According to economic theory, transfer price equals marginal costs. An MNC wishing to move funds from subsidiary A to subsidiary B would raise the transfer prices on the items shipped from subsidiary A to subsidiary B. Because of variations from country to country in tax structure, foreign exchange regulations, and foreign investment policy, some subsidiaries will be better profit generators than others.

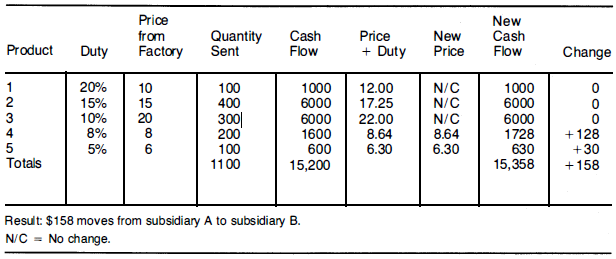

An MNC that desired to use transfer pricing as a means of moving funds from one subsidiary to another would increase the transfer price by the amount of the duty imposed by the country for which the funds were destined. Figure 12.6 gives an example of a transfer price increase situation. Products 1, 2, and 3 are subject to noticeably higher duty fees (20%, 15 % , and 10% , respectively), so their prices are not raised in an attempt to incorporate duties. Therefore the new prices remain the same as the original factory prices. Products 4 and 5, however, are subject to lower duties (8% and 5% , respectively), and thus their prices can be increased from the original factory prices relatively inconspicuously.

An alternative way of moving funds from one subsidiary to another is to invoice the goods through a chain of subsidiaries, each of which adds its commission. This "chain invoicing" is less suspect than transfer price increases and therefore is subjected to less scrutiny by government authorities. Figure 12.7 illustrates chain invoicing.

- 1835 reads