Dividends are the price a company pays for the use of stockholders' money. The portion of a company's after-tax profit that will be declared as dividends depends on management's perception of the company's financial and investment needs. For example, if management plans to expand the company's productive capacity and wishes to self-finance this expansion, a larger portion of the profits will go into retained earnings and less will be declared as dividends.

Dividends represent taxable income in most countries. Thus MNCs, one of whose main objectives is to maximize shareholders' wealth, try to distribute dividends so as to minimize the tax burden. Because dividends may be taxed every time they enter and leave a country, the MNC must determine how much of a proposed dividend payment would accrue to each subsidiary and how much would get back to the parent.

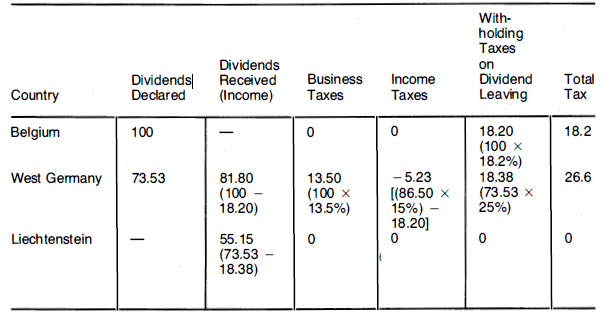

Suppose an MNC has a subsidiary in Liechtenstein, which in turn has a subsidiary in West Germany, which in turn has a subsidiary in Belgium, which declares a dividend of 100 units. Figure 12.8 shows the tax implications of this dividend declaration.

The Belgian government has a withholding tax of 18.2%, so 81.80 units arrive in West Germany from the Belgian subsidiary. The West German business tax, based on the entire dividend of 100, is 13.50%, so income net of business tax is 86.50. Company income tax is 15% of income net of business tax. (This rate is for income that will be used for dividends; income retained within the firm is taxed at 51 percent.) At this point, however, credit is granted for the Belgian withholding tax of 18.20 units. Thus the company income tax is -5.23, or (86.5 x 15%) -18.20. Combining this tax credit with the West German business tax of 13.50 units brings the total tax to 8.27 units. That is to say, only 73.53 units of the 100-unit dividend declared by the Belgian subsidiary get to its West German parent.

The West German subsidiary uses this dividend to declare a dividend of 73.53 units to its parent in Liechtenstein. But the government of West Germany imposes a 25% withholding tax on dividends leaving West Germany, so only 55.15 units arrive at the parent in Liechtenstein. That nation levies no taxes on dividends received from abroad, so the parent receives the entire 55.15 units-just over half of the original dividend declared by the Belgian subsidiary.

- 1824 reads