Funding is essentially a two-step process. In step one management makes the basic funding decisions. For example, management must decide on the amount of funds to be borrowed and the amount to be exchanged for equity participation-the debt-to-equity ratio. Traditionally, U.S. management has preferred equity to debt. European and, to a much greater extent, Japanese MNCs tend to choose debt financing.

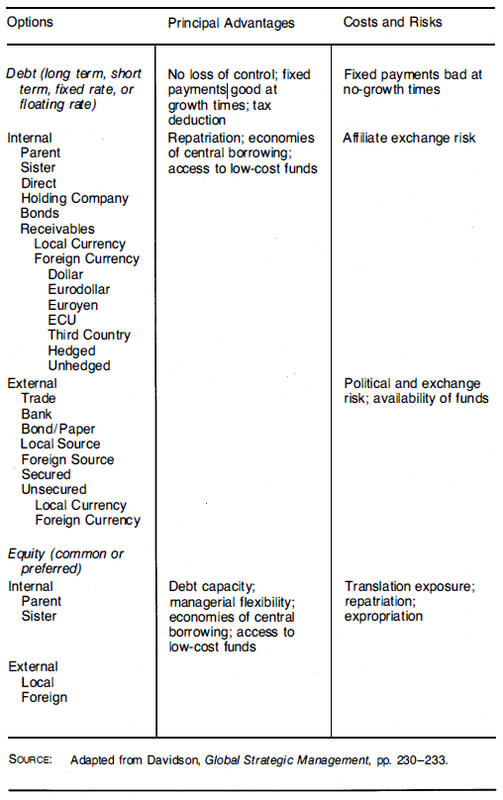

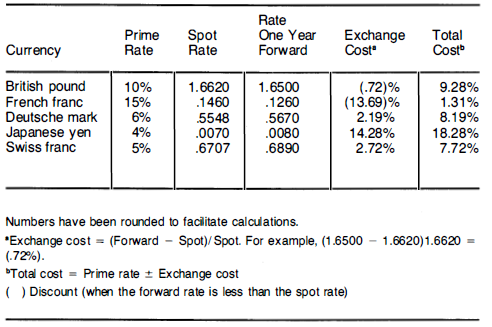

Contemporary financial markets are in a state of extreme turbulence. Financial institutions are daily creating new financial instruments and techniques that offer numerous opportunities for funding. Figure 12.11 presents a sample of the options available and suggests some of the advantages and disadvantages associated with each class of options. An MNC will most likely decide to use a combination of funding techniques and a portfolio of currencies. Step two, which involves actually finding and delivering the funds, is then handled by the company treasurer. One of the treasurer's tasks is determining the cost of funding. Detailed treatment of the various approaches to this complex task is beyond the intent of this book. Figure 12.12 demonstrates the basic idea of estimating financing costs in different currencies.

As the exhibit shows, there are two main components of the total cost: the prime rate and the exchange cost. 1 There is an inverse relationship between the prime rate and the change in the exchange rate: high-prime-rate currencies sell at a discount; low-prime-rate currencies are forwarded at a premium. Thus England and France, for example, have high prime rates and discounted currencies. Losses in the exchange market are deducted from interest cost, and gains are added to it.

- 2250 reads