The last chapter dealt with the exchange of goods and services across national boundaries. This chapter deals with the exchange of money that must follow each exchange of goods and services. Every purchase/ sale of a good or service must be translated into some type of monetary transaction. Thus, all international trade transactions sooner or later become financial transactions. International finance deals with how exchanges of goods and services translate into monetary transactions.

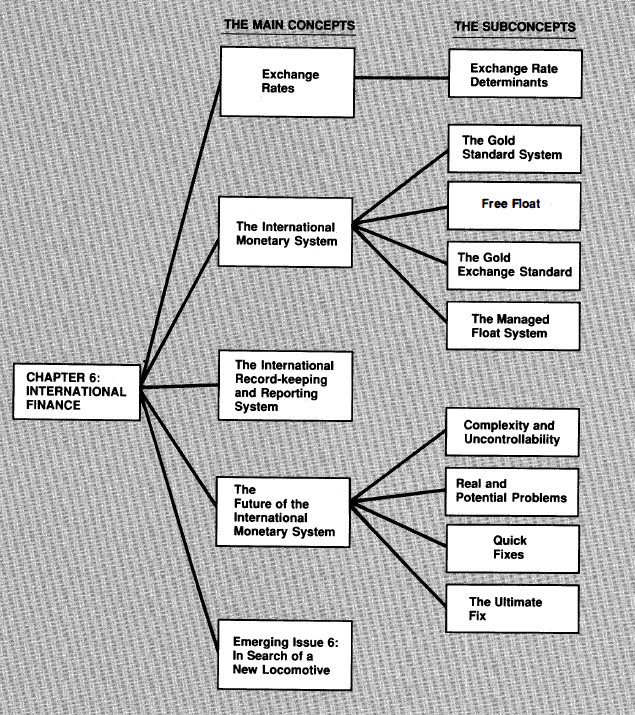

Like the previous two chapters, this chapter will first address the theoretical aspects of the topic and then examine some policy issues. Finally, in the last part of the chapter the quantitative and qualitative aspects of international finance will be discussed. There are two main aspects of international finance that any student must understand: the International Monetary System and the international record-keeping system.

The International Monetary System (lMS) represents a set of rules and regulations aimed at facilitating the expansion of international trade without jeopardizing either individual national economies or the entire world economy. The key issue is the design of a system as "neutral and automatic" as possible, which is difficult for any single government to manipulate yet flexible enough to allow for temporary violations without great risk of disasters.

The international record-keeping system is another set of rules and regulations, governing the recording and reporting of financial transactions among countries. This record-keeping and reporting system is widely known as the balance-of-payments accounts or simply the balance of payments.

LEARNING OBJECTIVES

After studying the material in this chapter, the student should be familiar with the following concepts:

- Exchange rates and their determinants

- The International Monetary System (IMS), its history and problems

- Free float and managed float

- The international record-keeping system (balance of payments)

- EMS, ECU, and DEY

- International debt

- Optimal bankrupts

- 1972 reads