The subject of strategic management will be dealt with formally in THE MANAGEMENT OF GLOBAL OPERATIONS of this book. Here let us consider it briefly in order to put the theme of the book in perspective. Most management textbooks list "strategic planning" as the main task of strategic management. In other words, strategic management is considered to be the implementation of the strategic plan of a firm. International management literature likewise assigns to the manager the task of developing and implementing the company's strategic plan. Strategic planning in turn, is defined as planning that exhibits the following characteristics:

- It involves only the top management level of an organization (locus).

- It is long-term (time).

- It focuses primarily on external factors (focus).

This tripartite model of strategic planning might be adequate for a small company and/or a company that is predominantly domestically oriented. The model is, however, inadequate when it comes to devising and implementing the strategic plan of a multinational corporation (MNC). In a company with the degree of complexity of a typical MNC, the hierarchical locus, the planning horizon (time), and the types of factors involved (focus) are difficult to pinpoint. For these reasons, strategic planning and management will be defined in this book by the following additional characteristics:

- The contemplated actions involve the integrated allocations of a significant portion of organizational resources.

- The contemplated actions involve large uncertainties about possible outcomes.

- The contemplated actions cannot be reversed, except at great cost, increasing with time. 1

The addition of these three characteristics to the definition of strategic planning is very important, for internationalization of a business's activities is a process that involves substantial resources, is exceedingly uncertain, and is not easily reversible.

Planning, one of the most important management activities, can be defined as thinking before action. More specifically, R. L. Ackoff defines planning as "the design of a desired future and of effective ways of bringing it about." 2 Designing a desired future for an organization is, of course, tantamount to predicting the organization's ability to survive in the future environment. Thus, the process of devising a strategic plan involves thinking about and analyzing the relationship between the organization and its external environment for some time into the future and then implementing effective ways of setting and accomplishing organizational goals. In short, organizational objectives and goals are set after a careful estimation of the environment's future state has been juxtaposed against the organization's strengths and weaknesses.

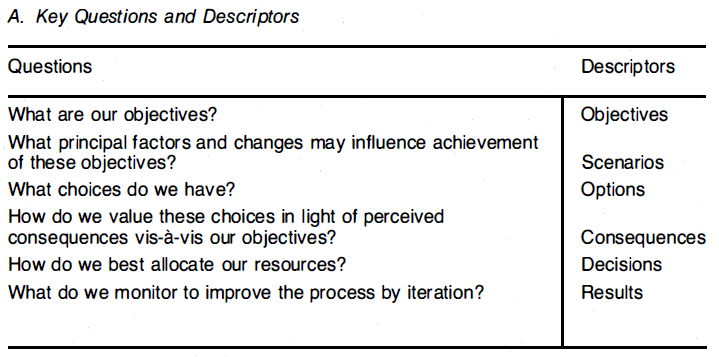

Figure 2.4 presents a list of the key questions one must ask when involved in strategic planning and a diagram of a corporate planning framework. The lower portion of the diagram (area III) depicts the three main elements of corporate planning: the environment, the corporation, and the stakeholder. The middle portion (area II) shows management as the process of thinking about/analyzing the three main elements and acting on/implementing them. The upper portion (area I) illustrates management's modeling process. Thus, the environment is dealt with by management via the Environmental Model, the corporation via the Corporate Model, and stakeholders via the Value Model. Management's overall task is to make a statement that answers the what if's with so what's. In other words, management must estimate the future state of the environment (create scenarios), assess the corporate strengths and weaknesses (estimate the consequences), and then tell the stakeholders how their goals will be achieved (set objectives).

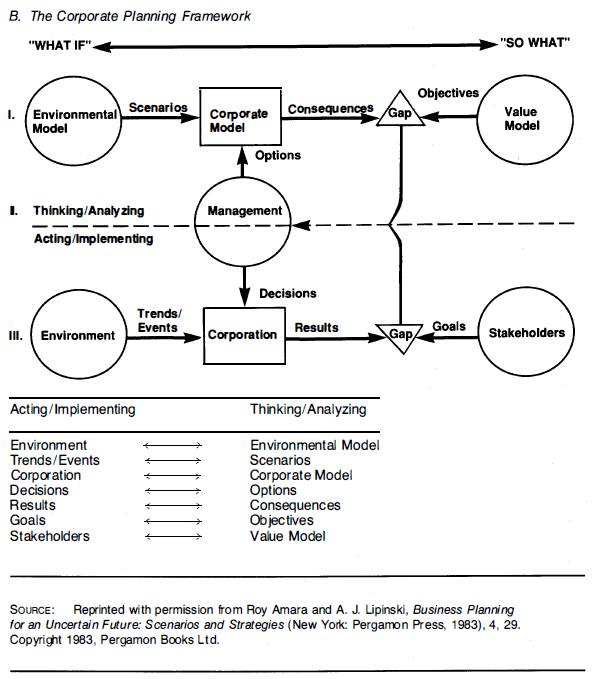

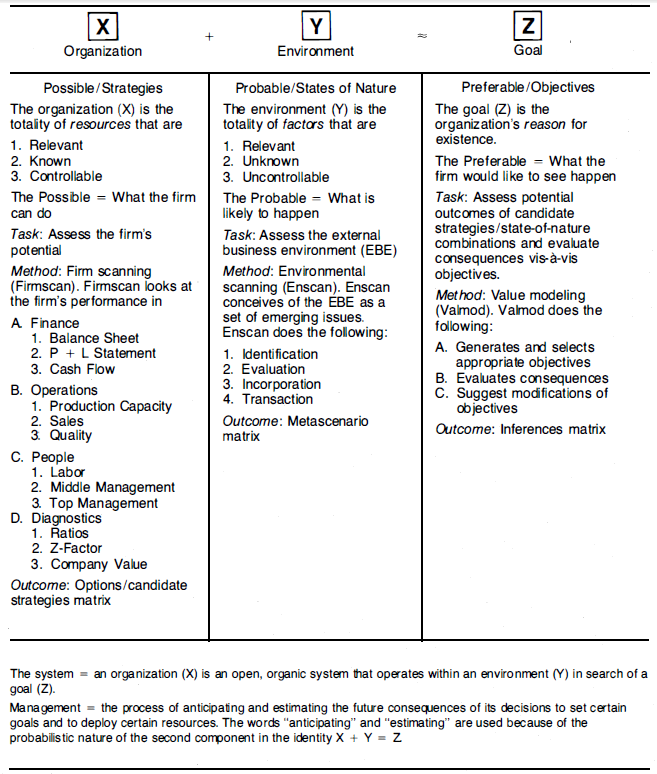

The entire strategy-setting process depicted in Figure 2.5 consists of management's attempt to maximize the quality of decisions—or, alternatively, to minimize the difference between intended/desired outcomes and actual outcomes, surprise factors, or unanticipated consequences. The quality of a decision is determined by the degree of congruence between intended and actual results.

Management's ability to produce quality decisions depends on three main sets of factors: the controllable (options or alternatives), the uncontrollable (states of nature or the environment), and the objectives (corporate goals). The controllable factors (X in Figure 2.5) represent the possible—the company's capabilities. The uncontrollable factors (Y in Figure 2.5) represent the probable—what is most likely to happen in the external environment. The goals and objectives (Z in Figure 2.5) represent the preferable—what management would like to see happen. 3 These factors might be called the "three Ps" of the strategic management process.

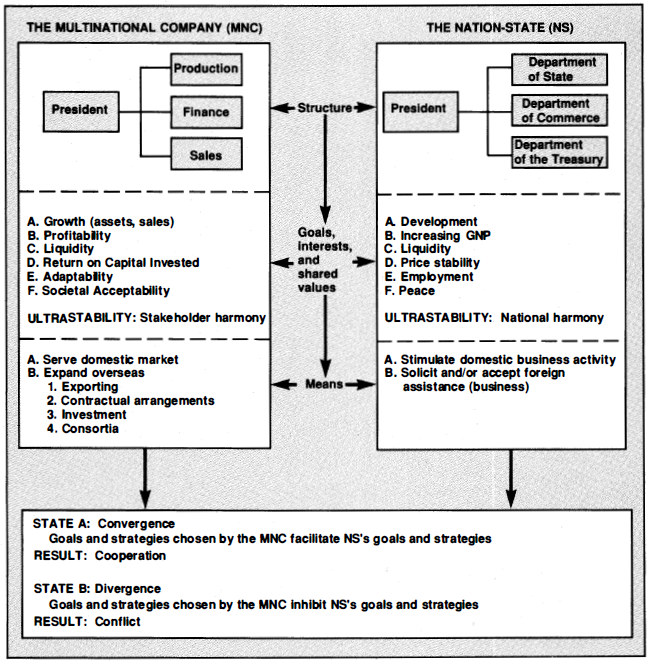

Figure 2.6 depicts the strategic management process as an interface between the multinational corporation and the nation-state (NS). Both the MNC and the NS have their unique structures; goals, interests, and shared values; and means of achieving them. These two subsystems are linked to each other in such a way as to form a synergistic relationship in which, ideally, the end result of the interaction is always greater than the sum of the individual parts. When this happens, the system has reached a state of homeostatic equilibrium that is ultrastable (stable under any disturbance). Let us take a closer look at the details of Figure 2.6. The two subsystems, the MNC and the NS, are the two main parts of a supersystem called the MNC-NS synergy. Each subsystem has its own organizational infrastructure and its own goals, interests, and shared values. The MNC must be ultrastable with respect to its stakeholders. They must be satisfied under any condition. (See Table 2.1.) The NS, on the other hand, must make sure that its interaction with the MNC will not disrupt its ultrastability with the state's stakeholders (citizens, pressure groups, and nature).

|

U. S. National Interests A. Political 1 . U.S. unity 2. U.S. democracy and liberty 3. Democratic institutions throughout the world 4. Individual liberty throughout the world B. Economic Welfare 1 . Of U.S. citizens a. access to raw materials b. U.S. trade c. U.S. investments d. efficient world monetary system e. limited harmful pollution 2. Of other nations' citizens C. Military 1 . Preventing attacks on United States 2. Defending United States against attacks that do occur 3. Preventing military attacks on U.S. interests, and defending those interests when other means prove inadequate D. Moral/Psychological/Cultural 1 . Safety of U.S. citizens 2. U.S. citizens' access to diverse cultures, experiences, ideas, travel 3. Amelioration of human suffering worldwide—genocide, war, starvation, slavery, political oppression E. Managerial 1 . Credibility—global reputation for sincerity and ability to fulfill commitments 2. Intelligence—access to information affecting U.S. interests and ability to attain those interests 3. Good morale—sense of confidence, rectitude, effectiveness 4. Effective U.S. organization F. General Whenever interests are being discussed on a regional or local basis, using the above list, it is always necessary to add an interest in facilitating attainment of U.S. interests elsewhere. |

|

Key Corporate Interests A. Overall Profitability B. Assets 1. Equity position 2. Rights to land, minerals, etc. C. Organizational 1. Decision-making capability 2. Staffing capability 3. Safety and comfort of employees D. Operational 1. Access to equipment 2. Access to raw materials 3. Technology 4. Ability to import and export 5. Ability to transfer funds E. Markets 1. Continued access to existing markets 2. Access to new and growing markets |

|

SOURCE: W. Aschen and W. H. Overholt, Strategic Planning Forecasting: Political Riskand Economic Opportunity (New York: John Wiley and Sons, 1986), 23-24. Copyright © 1986 John Wiley & Sons, Inc. Reprinted by permission of John Wiley & Sons, Inc. |

Each subsystem can reach its goals or fulfill its interests either by depending on its own environment or by expanding its environment's physiological, cognitive, and economic limits through making an offer to interact with the other. Attempts to overcome the limits set by each subsystem's environment may result in cooperation or in conflict.

State A: Convergence. Suppose the managers of the MNC decided that by investing in the NS they could realize their goal of growth. If the NS saw this interaction as assisting in the accomplishment of its goals of development, growth (increase GNP), liquidity (saving foreign exchange for imports), and employment, the ultimate result would be cooperation.

State B: Divergence. If, however, wages paid to MNC employees were much higher than local wages, the MNC's decision to invest in the NS might be perceived as conflicting with the NS's goal of price stability. By the same token, the NS's decision to stimulate domestic business activity might be perceived as hindering the MNC's strategy of exporting to the NS. The ultimate outcome of this state of divergence would be conflict.

The majority of the criticism levied at MNCs for exploitative behavior and at NSs for unreasonable dictatorial actions would be eliminated if both parties accepted the necessity for interaction and perceived the game as a non-zero-sum/win-win game and not as a zero-sum/win-lose game.

- 3443 reads