An income statement communicates information about a business’s financial performance by summarizing revenues less expenses over a period of time. Revenues are created when a business provides products or services to a customer in exchange for assets. Assets are resources resulting from past events and from which future economic benefits are expected to result. Examples of assets include cash, equipment, and supplies. Assets will be discussed in more detail later in this chapter. Expenses are the assets that have been used up or the obligations incurred in the course of earning revenues. When revenues are greater than expenses, the difference is called net income or profit. When expenses are greater than revenue, a net loss results.

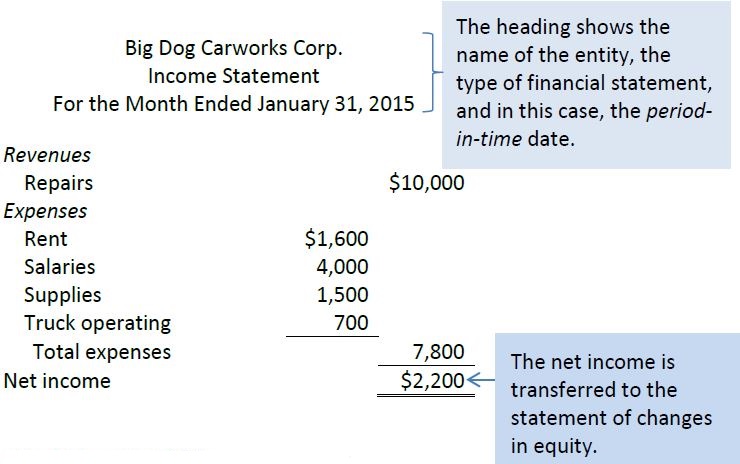

Consider the following income statement of Big Dog Carworks Corp. (BDCC). This business was started on January 1, 2015 by Bob “Big Dog” Baldwin in order to repair automobiles. All the shares of the corporation are owned by Bob.

At January 31, the income statement shows total revenues of $10,000 and various expenses totalling $7,800. Net income, the difference between $10,000 of revenues and $7,800 of expenses, equals $2,200.

- 4021 reads