Recall that under the perpetual inventory system, cost of goods sold is calculated and recorded in the accounting system at the time when sales are recorded. In our simplified example, all sales occurred on June 30 after all inventory had been purchased. In reality, the purchase and sale of merchandize is continuous. To demonstrate the calculations when purchases and sales occur continuously throughout the accounting period, let’s review a more comprehensive example.

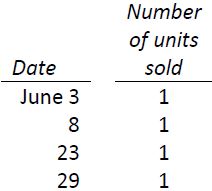

Assume the same example as above, except that sales of units occur as follows during June:

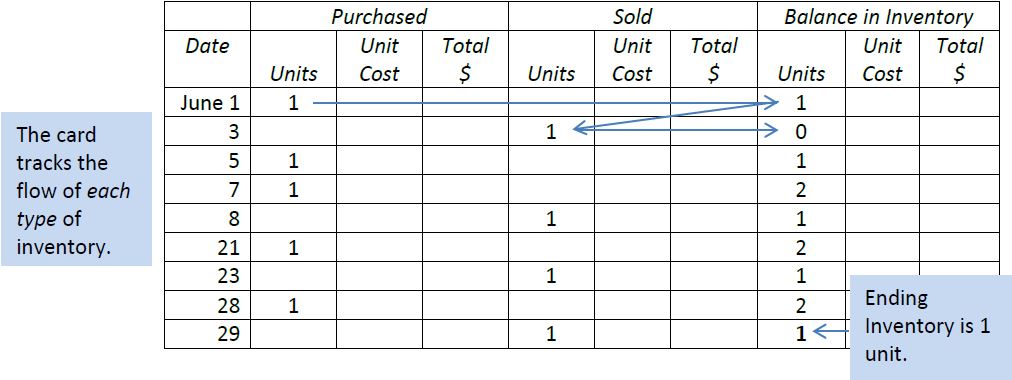

To help with the calculation of cost of goods sold, an inventory recordcard will be used to track the individual transactions. This card records information about purchases such as the date, number of units purchased, and purchase cost per unit. It also records cost of goods sold information: the date of sale, number of units sold, and the cost of each unit sold. Finally, the card records the balance of units on hand, the cost of each unit held, and the total cost of the units on hand.

A partially-completed inventory record card is shown in Figure 6.5 below:

In Figure 6.5, the inventory at the end of the accounting period is one unit. This is the number of units on hand according to the accounting records. A physical inventory count must still be done, generally at the end of the fiscal year, to verify the quantities actually on hand. As discussed in Chapter 5, any discrepancies identified by the physical inventory count are adjusted for as shrinkage.

As purchases and sales are made, costs are assigned to the goods using the chosen cost flow assumption. This information is used to calculate the cost of goods sold amount for each sales transaction at the time of sale. These costs will vary depending on the inventory cost flow assumption used. As we will see in the next sections, the cost of sales may also vary depending on when sales occur.

- 2708 reads