To illustrate the concept of leverage, consider the following example:

|

Company A |

Company B |

|

|

Total assets |

$400,000 |

$400,000 |

|

Bonds (12%) |

-0- |

200,000 |

|

Shareholders’ equity |

400,000 |

200,000 |

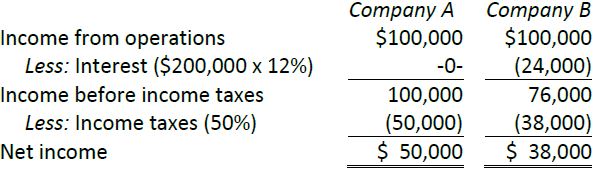

Although both A and B have the same amount of assets – $400,000. However, company A has no long-term liabilities. Company B has $200,000 of 12% bonds. If both companies earn income from operations of $100,000, do they have a similar return on total assets and shareholders’ equity? First, net income needs to be determined, as follows:

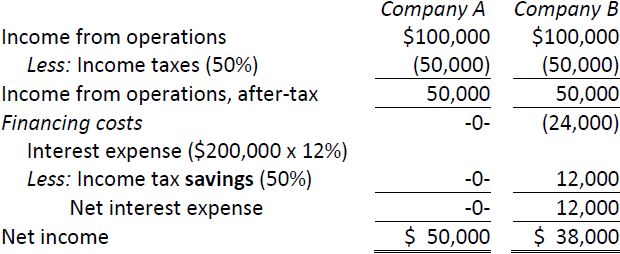

The use of long-term financing results in a lower net income figure for company B because of interest expense ($24,000). This is mitigated somewhat by the lower income taxes expense that results for company B ($38,000 vs. $50,000). The difference occurs because the interest expense incurred by B is a deductible expense for income tax purposes. As a result, B’s net interest expense is only $12,000, and its after-taxcost of borrowing is 6% (12% x 50%). When an interest expense is recorded separately and an income taxes expense is allocated between income from operations and interest expense, this becomes more apparent:

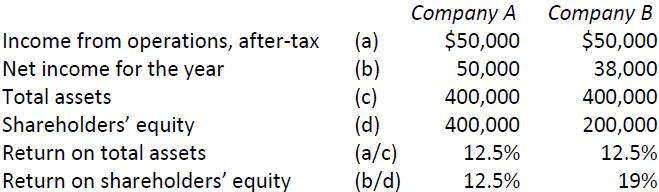

Now consider the implications of this higher debt load on the calculation of after-tax return on total assets and return on shareholders’ equity:

The return on total assets is 12.5% for both companies; however the return on shareholders’ equity is considerably greater for company B (19% vs. 12.5% = 6.5%). This is because company B borrowed funds at an after-tax cost of 6% to earn a 12.5% return on the assets it purchased. This 6.5 cent gain for every $1 borrowed (12.5% – 6%) accrues to shareholders of company B and therefore increases or leverages return on shareholders’ equity.

However, there is risk involved in leveraging. While return on shareholders’ equity is increased when the return on related assets exceeds the cost of borrowing the funds, the opposite occurs. In this case, return on shareholders’ equity is decreased. As a result, and in general, companies with stable earnings can carry more debt in their financial structures than companies with fluctuating earnings because there is less risk that the cost of borrowing will exceed the return on assets that the borrowed funds generate.

- 2397 reads