Available under Creative Commons-NonCommercial-ShareAlike 4.0 International License.

East Corp. entered into a finance lease agreement with West Leasing Ltd. on April 1, 2016. East Corp. agreed to pay West an initial payment of $10,000 on that date and annual payments of $71,081 on March 31 for the next three years to lease a piece of equipment with a fair value of $200,000. The interest rate implicit in the lease agreement was 6%.

|

Required: |

|

| 1. | Prepare the journal entry to record the purchase of the equipment and assumption of the lease on April 1, 2016. |

| 2. |

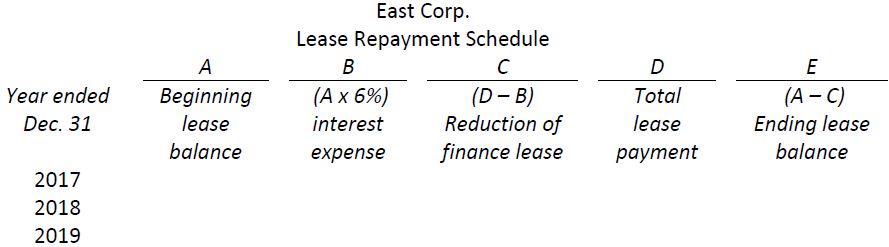

Prepare the lease repayment schedule as follows:

|

| 3. | Prepare the partial balance sheet of East Corp. at December 31, 2018 showing the finance lease balance assuming the December 31 lease payment has been made. |

- 2719 reads