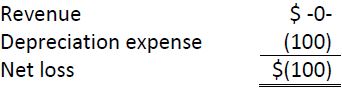

Assume the following income statement and balance sheet information:

|

2017 Dr. (Cr.) |

2016 Dr. (Cr.) |

|

|

Cash |

$350 |

$650 |

|

Machinery |

500 |

200 |

|

Accumulated depreciation – machinery |

(250) |

(150) |

|

Retained earnings |

(600) |

(700) |

No machinery was disposed during the year. All machinery purchases were paid in cash.

Required:

- Prepare a journal entry to record the depreciation expense for the year. Determine the cash effect.

- Prepare a journal entry to account for the change in the Machinery balance sheet account. What is the cash effect of this entry?

- Prepare a statement of cash flows for the year ended December 31, 2017.

- 1705 reads