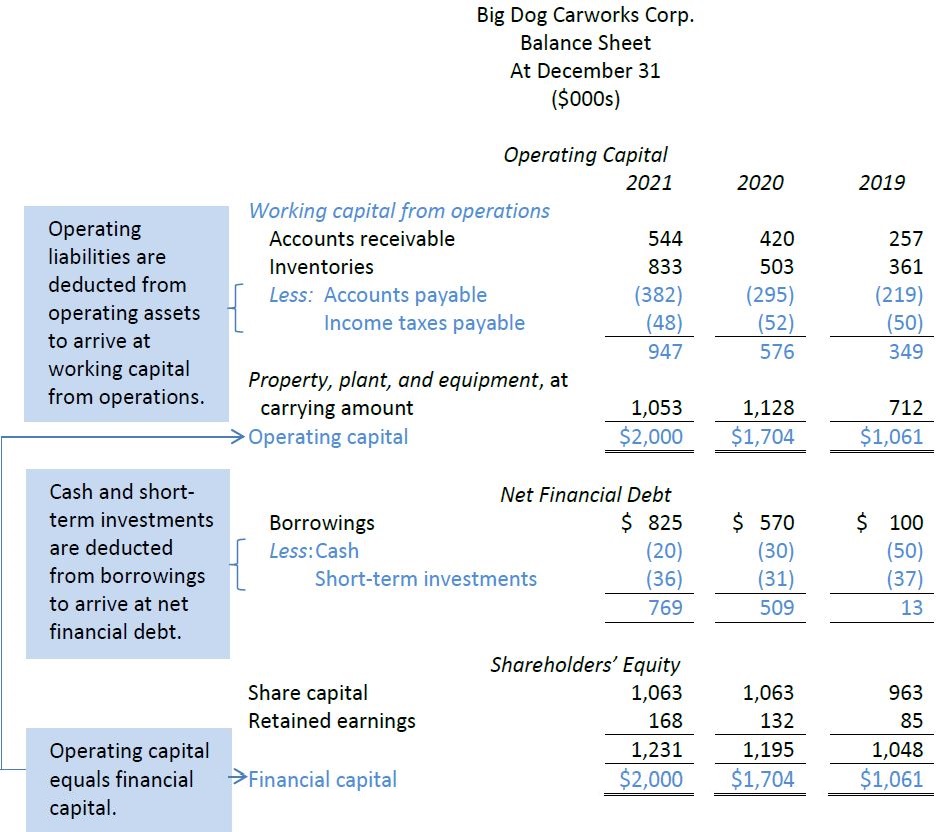

To add analytic power to the Scott formula analysis, the traditional balance sheet format is rearranged somewhat:

- Liabilities like accounts payable and income taxes payable that arise from normal operating activities are deducted from related assets like accounts receivable and inventory. This is called “working capital from operations”.

- Cash and short-term investments normally reported as current assets are deducted from borrowings to give a more representative picture of amounts actually owing to creditors (since these could be used to pay off debt if desired). The new amount is called “net financial debt”.

- With these changes, total assets are now called “operating capital”. The total of net financial debt and shareholders’ equity is now called “financial capital”. Operating capital always equals financial capital, just as total assets always equals total liabilities plus shareholders’ equity on a standard balance sheet.

Recall the Big Dog Carworks Corp. balance sheet presented in Figure 13.2 above. For Scott formula analysis, this would be re-cast as follows:

Some changes are also made to the presentation of income taxes expense on the BDCC income statement, using the same concept as illustrated in Figure 13.7 above.

| 1. |

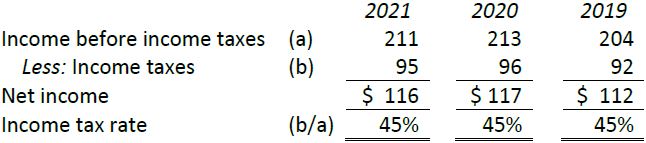

First, the average income tax rate needs to be calculated. This is 45% for all three years, derived from Figure 13.2 as follows:

|

| 2. | Based on this rate, income taxes expense is allocated between income from operations and interest expense, as shown below: |

Allocating income taxes expense in this manner lowers income from operations as previously stated (for example in 2021 from $300 to $165), and decreases interest expense by 45% (for example in 2021: from $89 to $49).

The Scott formula can now be used to calculate how much of BDCC’s return on shareholders’ equity is derived from operations (return on assets) and how much is derived from leverage. It is calculated as:

RETURN ON CAPITAL + RETURN ON LEVERAGING = RETURN ON SHAREHOLDERS’ EQUITY

Return on capital and return on leveraging will be examined more closely below.

- 4393 reads