As also discussed earlier, the bond premium or discount is amortized over the bond life remaining from the date of the bond’s issue. The straight-line method allocates an equal amount of amortization to each semi-annual interest period. The simplicity of this method makes it appropriate as an introduction to the bond accounting process.

However, GAAP requires the use of the effective interest amortization method. Under this method, the amount of amortization calculated differs from one period to another but produces a more appropriate rate of interest expense when it is recognized in the income statement.

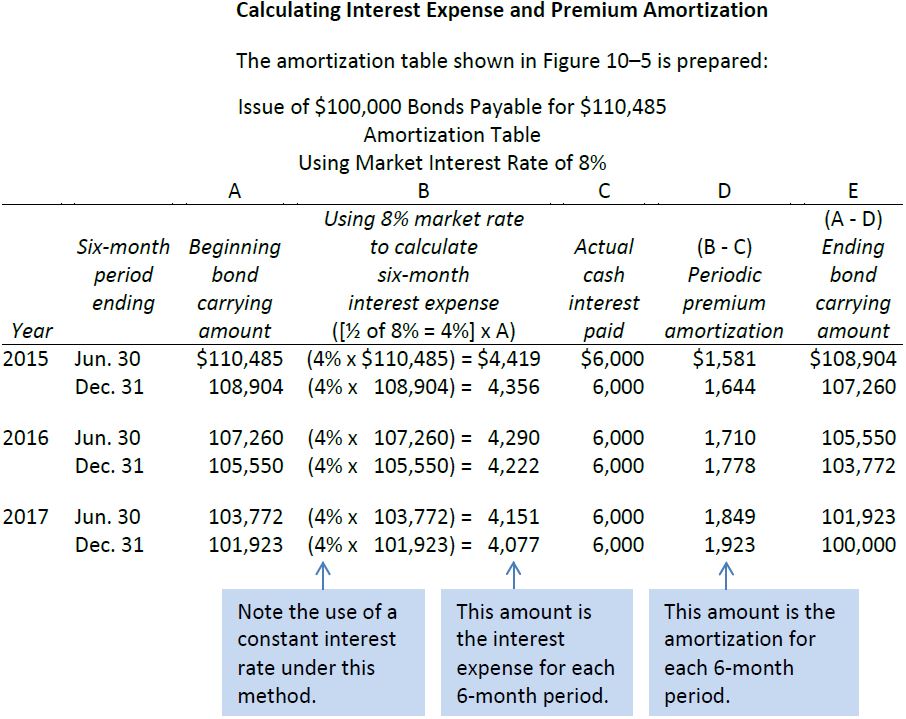

The calculation is facilitated through the preparation of an amortization table. To illustrate, assume that Big Dog Carworks Corp. uses this method of amortization and again issues 8%, three-year bonds with a face value of $100,000 on January 1, 2015. The issue price is $110,485.

The calculation begins with the $110,485 issue amount in period 1 (January 1 to June 30, 2015). The objective of this amortization method is to reduce this carrying amount to the face value of $100,000 over the life of the bonds; the decrease is shown in column E of the table.

In this case, the market interest rate of 8% is expressed as an annual rate. Because BDCC makes semi-annual interest payments, the six-month rate is 4% (half of the 8% annual rate), which is the rate used in column B for each semi-annual period. (For convenience, all column B calculations are rounded to the nearest dollar.)

The calculation in column D provides the premium amortization amount for each period. In period 1, for example, the difference between the $4,419 market rate interest expense (column B) and the $6,000 actual bond contract interest paid (column C) determines the premium amortization of $1,581 (column B – column C). Columns E and A show the decreasing carrying amount of the bonds during their three-year life.

The advantage of the effective interest method is that it calculates interest expense at a constant 4% each period. Interest expense (column B) decreases each period. From a theoretical point of view, it is preferable to show a financing interest expense that decreases (column B) as the amount of bonds outstanding decreases (column A), as this produces a constant rate of borrowing.

- 6979 reads